For the 24 hours to 23:00 GMT, the GBP traded marginally lower against the USD and closed at 1.5976, despite the UK registering upbeat manufacturing PMI data in October.

Manufacturing activity in Britain unexpectedly expanded to a 3-month high level of 53.2 in October, more than market expectations for a fall to a level of 51.4 and following a revised level of 51.5 recorded in September.

Yesterday, a leading think tank report revealed that the UK economy has won among all other major EU countries to become the world’s most prosperous nations. Following this revelation UK Chancellor George Osborne stated that the study supported the government’s long-term economic plans.

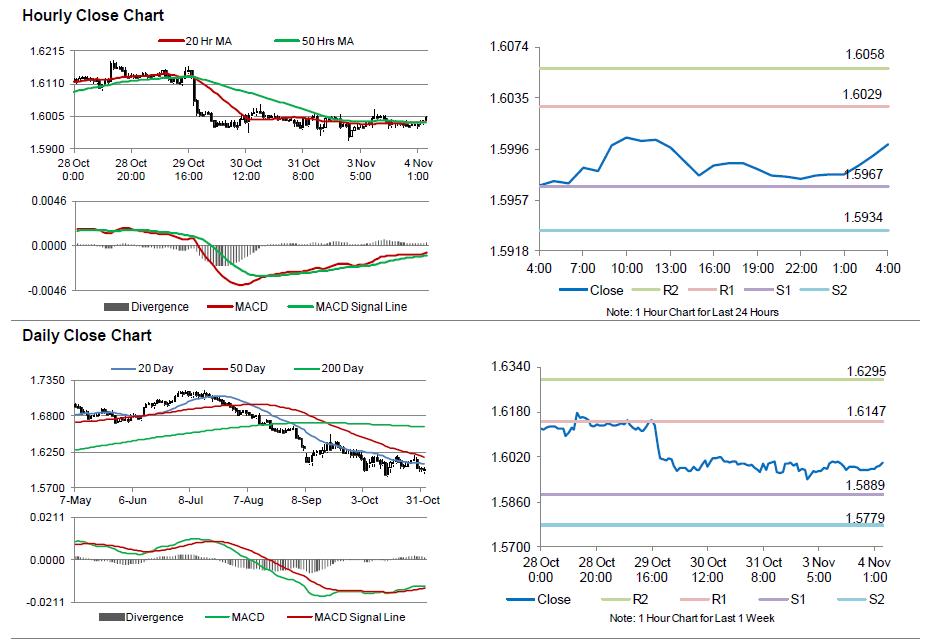

In the Asian session, at GMT0400, the pair is trading at 1.600, with the GBP trading 0.15% higher from yesterday’s close.

The pair is expected to find support at 1.5967, and a fall through could take it to the next support level of 1.5934. The pair is expected to find its first resistance at 1.6029, and a rise through could take it to the next resistance level of 1.6058.

Going forward, investor sentiments would be governed by Britain’s construction PMI data, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.