For the 24 hours to 23:00 GMT, the EUR declined 0.38% against the USD and closed at 1.2424.

In economic news, the ECB announced that it slowed down its purchase of covered-bonds to €2.629 billion of assets in the week ended 10 November, lower than its earlier purchase of €3.075 billion of assets in the prior week. The ECB has purchased a total of €7.408 billion of covered-bonds since it revealed the plan on October 27, 2014.

On the other hand, the Euro-zone’s Sentix investor confidence index registered an unexpected rise to a level of -11.9 in November, compared to a reading of -13.7 in the prior month, while markets were anticipating the investor confidence index to ease to a level of -13.8.

Elsewhere, in Italy, industrial production recorded a drop of 0.9% on a monthly basis in September, higher than market expectations for a drop of 0.2% and after registering a revised rise of 0.2% in the prior month.

Separately, the ECB Executive Board Member, Yves Mersch stated that the central bank was ready to purchase asset-backed securities (ABS) next week as part of a stimulus plan.

In the US, the Boston Fed President, Eric Rosengren stated that the Fed should not raise its short term interest rates until its 2% inflation target was achieved as it might dent consumer spending and investment patterns that could further undermine the nation’s economic growth.

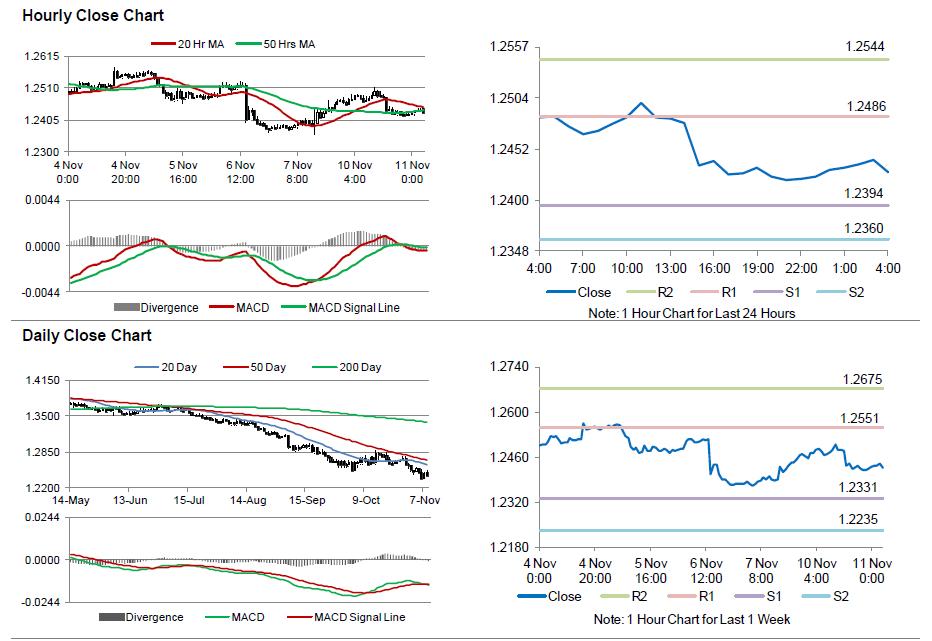

In the Asian session, at GMT0400, the pair is trading at 1.2428, with the EUR trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.2394, and a fall through could take it to the next support level of 1.2360. The pair is expected to find its first resistance at 1.2486, and a rise through could take it to the next resistance level of 1.2544.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.