For the 24 hours to 23:00 GMT, the GBP fell 0.27% against the USD and closed at 1.5846.

Yesterday, the BoE Governor, Mark Carney stated that the world’s biggest banks should be holding buffer of bonds in case if a global financial failure happens again, so that the respective government bail-out plans could be avoided.

In the Asian session, at GMT0400, the pair is trading at 1.5843, with the GBP trading marginally lower from yesterday’s close.

Earlier today, the British Retail Consortium (BRC) has reported that, Britain’s retail sales across all sectors remained flat in October, compared to a fall of 2.10% in the previous month. Markets were anticipating retail sales across all sectors to ease 0.50%.

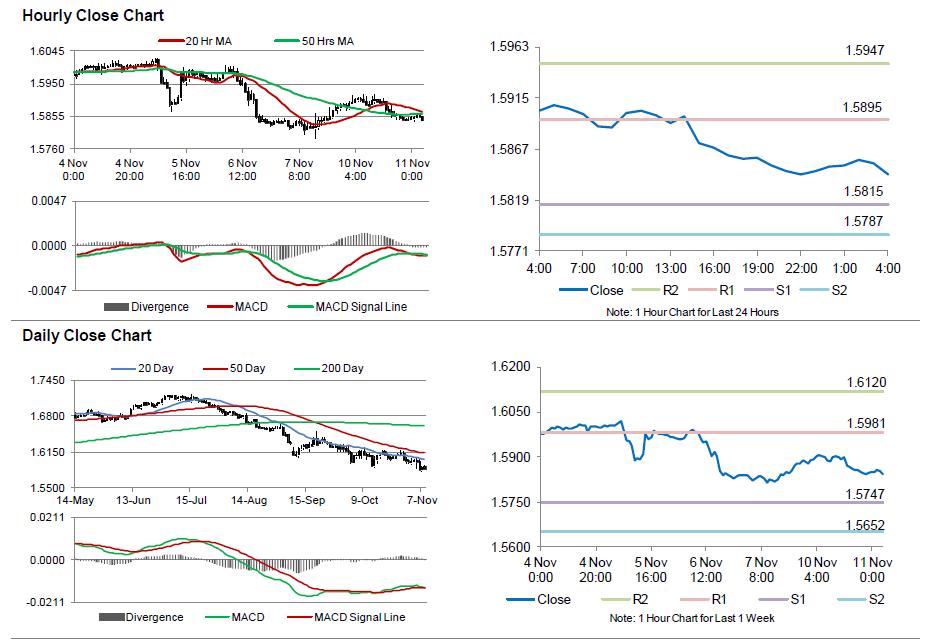

The pair is expected to find support at 1.5815, and a fall through could take it to the next support level of 1.5787. The pair is expected to find its first resistance at 1.5895, and a rise through could take it to the next resistance level of 1.5947.

Amid no economic releases from the UK today, investors await Britain ILO jobless rate data, scheduled tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.