For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1402.

Yesterday, the ECB agreed to raise the emergency funds available to Greek banks by €3.3 billion to €68.3 billion, as it was necessary for the Greek banks.

In economic news, the seasonally adjusted construction output in the Euro-zone dropped 0.80% (MoM) in December. In the prior month, construction output had recorded a revised drop of 0.50%.

In the US, the minutes of the Fed’s latest monetary policy meeting revealed that a majority of policymakers remained wary of raising interest rates earlier than anticipated as it could harm the nation’s economic recovery and labour market conditions.

In other economic news, industrial production in the US advanced 0.20% in January, less than market expectations for a rise of 0.30%, and compared to previous month’s revised drop of 0.30%. Meanwhile, the nation’s building permits unexpectedly dropped 0.7% on a monthly basis in January, lower than market expectations for a 0.9% rise. Additionally, housing starts slid more than expected by 2.0%, against an expected drop of 1.7% and following a revised increase of 7.1% in the previous month.

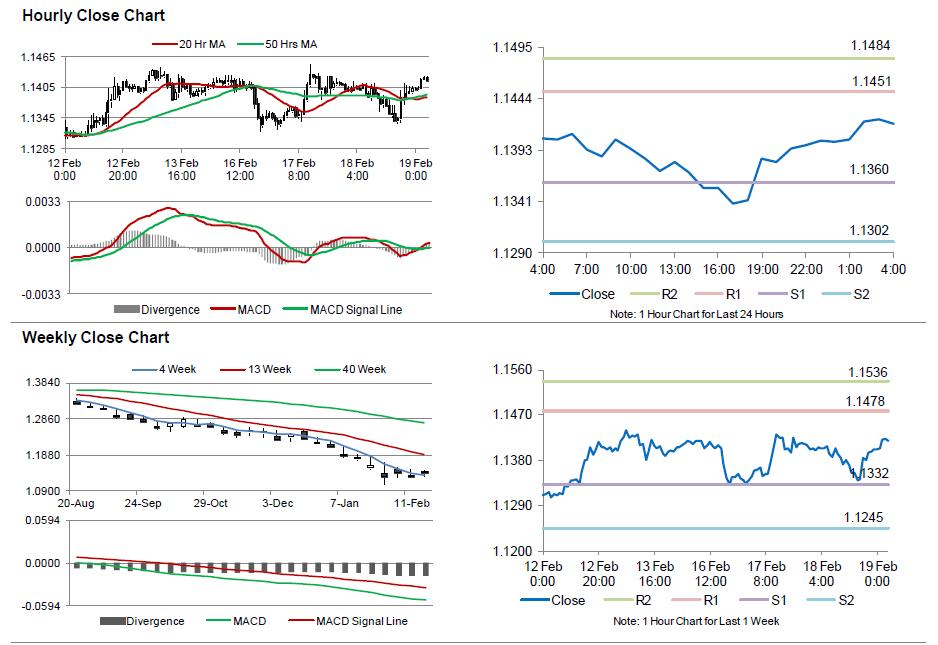

In the Asian session, at GMT0400, the pair is trading at 1.1419, with the EUR trading 0.15% higher from yesterday’s close.

The pair is expected to find support at 1.136, and a fall through could take it to the next support level of 1.1302. The pair is expected to find its first resistance at 1.1451, and a rise through could take it to the next resistance level of 1.1484.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s consumer confidence data, scheduled in a few hours. Additionally, the US initial jobless claims data would grab lot of market attention, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.