For the 24 hours to 23:00 GMT, the GBP rose 0.59% against the USD and closed at 1.5443, following upbeat employment report from the UK.

Data released showed that Britain’s ILO jobless rate surprisingly fell to a 6-year low of 5.7% for the three months ended December 2014, compared to market expectations of a steady reading of 5.8% registered in the previous three month period, thus fuelling optimism over the strength of the nation’s labour market. Additionally, number of unemployment benefits claimants eased by 38.60 K in January, compared to a revised loss of 35.80 K in the previous month, while markets expected it to drop to 25.00 K.

Separately, the BoE minutes from its recent monetary policy meeting revealed that the policymakers unanimously voted to keep interest rate in the UK on hold and kept its £375 billion asset purchase program unchanged. The minutes also revealed that inflation in the UK would grow quickly in 2016 once the effect of sliding oil prices fades away.

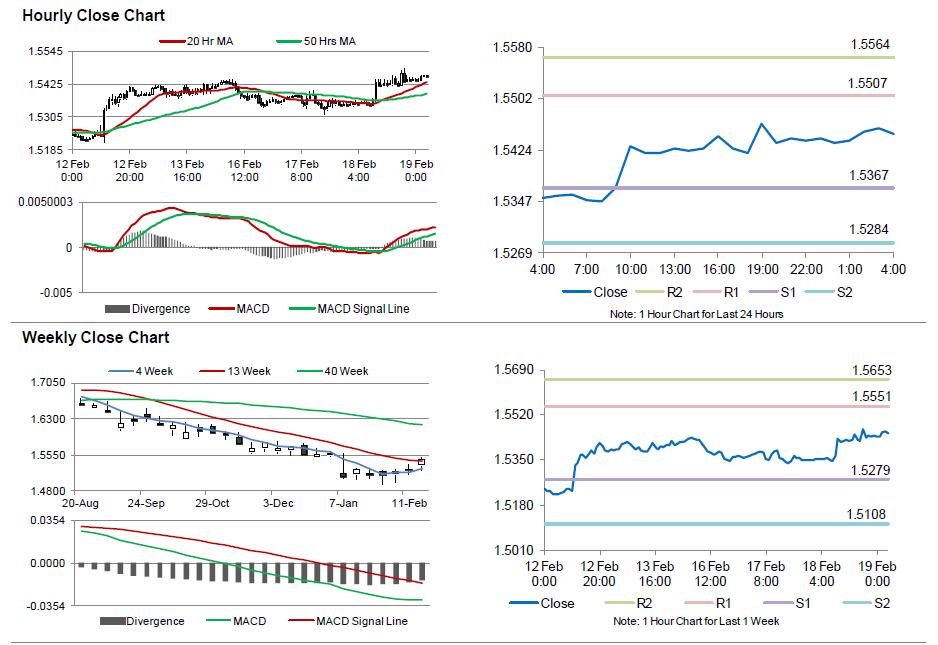

In the Asian session, at GMT0400, the pair is trading at 1.5450, with the GBP trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.5367, and a fall through could take it to the next support level of 1.5284. The pair is expected to find its first resistance at 1.5507, and a rise through could take it to the next resistance level of 1.5564.

Amid a light economic calendar in the UK today, investor sentiment would be governed by global macroeconomic news.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.