For the 24 hours to 23:00 GMT, EUR rose 0.93% against the USD and closed at 1.4505, as the US edged closer to missing a dealing to raise its debt ceiling.

If Congress fails to raise the nation’s debt limit by an August 2 deadline, the US would likely lose its AAA credit rating, setting off a chain of events that may threaten the fragile economy recovery.

In the economic news, the forward-looking consumer sentiment index in Germany declined to 5.4 in August from a revised 5.5 in July.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4507, flat from the levels yesterday at 23:00GMT.

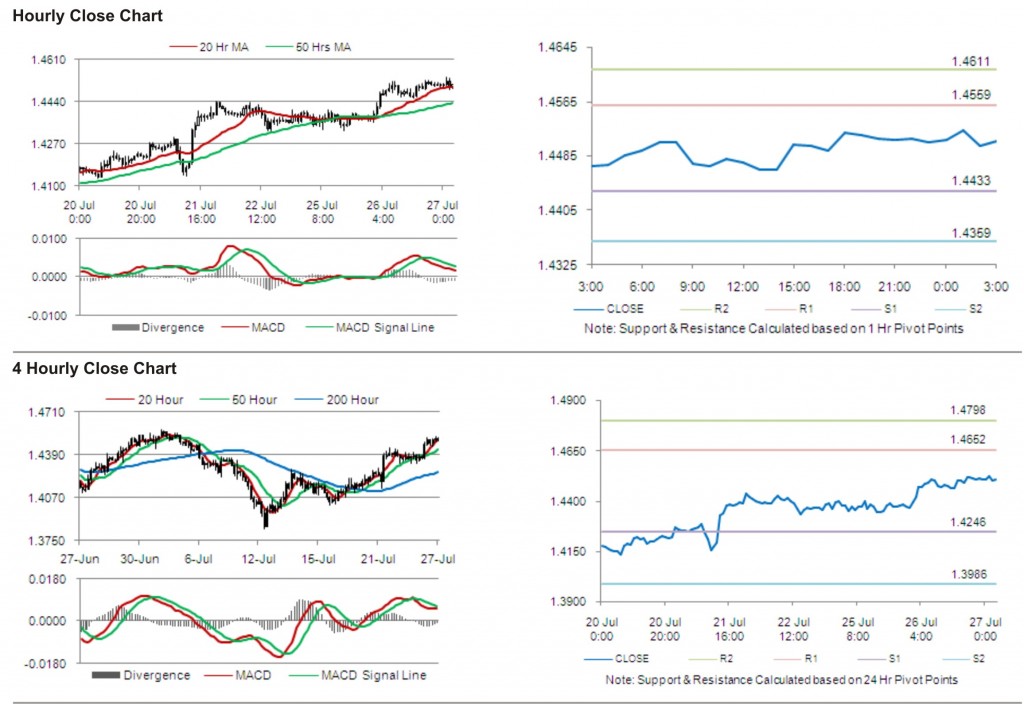

The pair has its first short term resistance at 1.4559, followed by the next resistance at 1.4611. The first support is at 1.4433, with the subsequent support at 1.4359.

Trading trends in the pair today are expected to be determined by money supply data release in the Euro zone.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.