For the 24 hours to 23:00 GMT, USD weakened 0.49% against the JPY and closed at 77.92, on concern that the US may default and face a reduction in its credit rating.

The President, Barack Obama administration threatened a presidential veto of House Speaker John Boehner’s two-step plan to raise the $14.3 trillion debt ceiling and cut $3 trillion in expenditure.

In the US, the new home sales, on a seasonally adjusted basis, declined by 1.0% to an annual rate of 312,000 in June, following a revised rate of 315,000 recorded in May.

In the Asian session at 3:00GMT, the pair is trading lower from yesterday’s close at 23:00 GMT, by 0.12%, at 77.83.

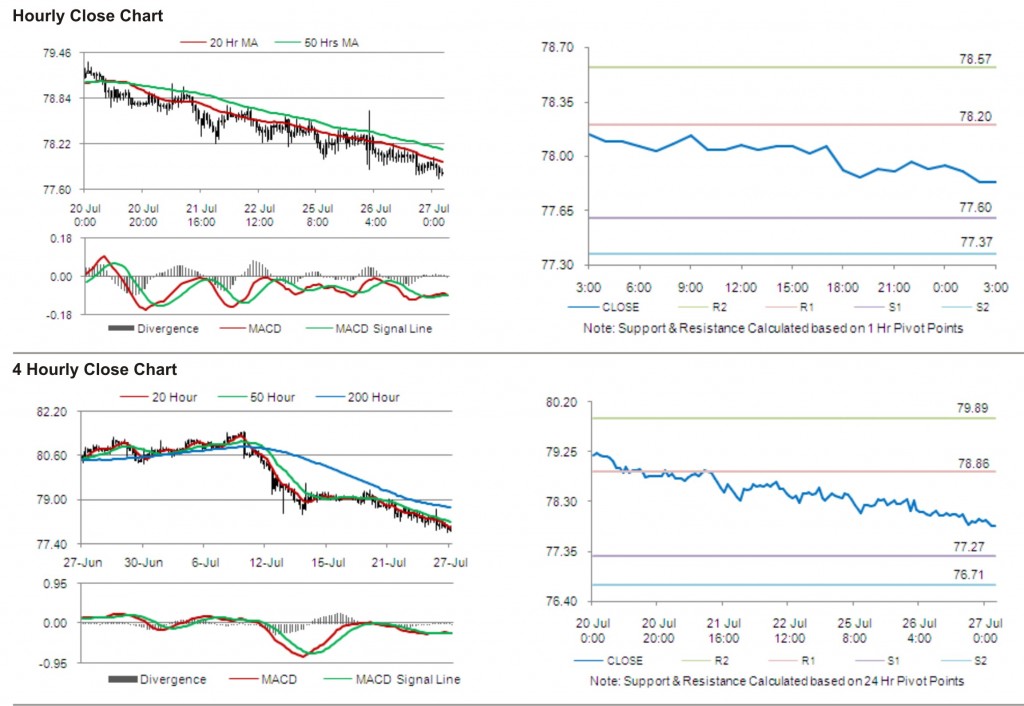

The first short term resistance is at 78.20, followed by 78.57. The pair is expected to find support at 77.60 and the subsequent support level at 77.37.

With a series of Japan economic releases today, including retail trade, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.