For the 24 hours to 23:00 GMT, EUR rose 1.83% against the USD and closed at 1.4224.

The greenback declined against the Euro after the Moody’s Investors Service put the US under review for a credit rating downgrade. Further, the greenback was pressurised following the Federal Reserve Chairman, Ben S. Bernanke’s statement that the policy makers may provide economic stimulus if needed.

Moreover, EUR received support after Italian Economy Minister, Giulio Tremonti stated that he expects parliament the pass the new austerity measures on Friday,

Moody’s Investors Service stated that it may cut the US’ triple-A rating, citing the rising chance that its debt ceiling may not be raised.

Also, the Fitch ratings agency announced yesterday that it was downgrading Greece’s status by three points to CCC status from its previous rating of B+, the lowest grade for any country in the world.

In the economic news, the industrial output in the Euro zone rose by 0.1% (M-o-M) in May, following a 0.2% increase recorded in the previous month. Additionally, in Germany, the wholesale price inflation, on an annual basis, declined to 8.5% in June, following a rate of 8.9% recorded in May.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4223, flat from the levels yesterday at 23:00GMT.

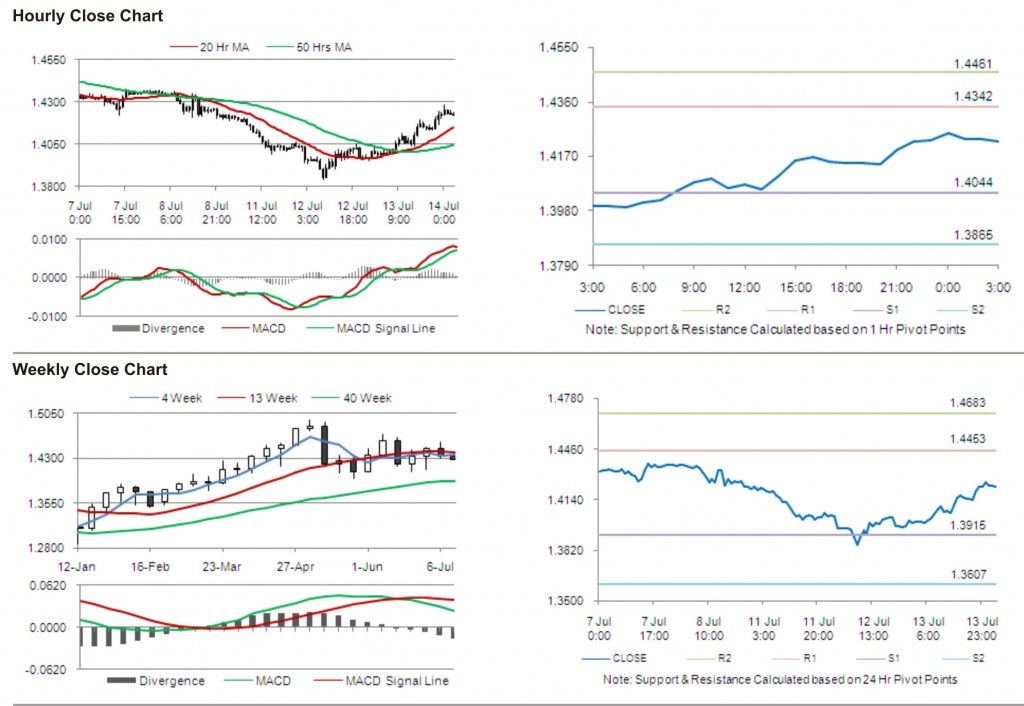

The pair has its first short term resistance at 1.4342, followed by the next resistance at 1.4461. The first support is at 1.4044, with the subsequent support at 1.3865.

Trading trends in the pair today are expected to be determined by release of consumer price index in the Euro Zone.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.