For the 24 hours to 23:00 GMT, USD weakened 0.55% against the JPY and closed at 78.96.

The Bank of Japan (BoJ) indicated that the economic activity in the country is ‘picking up’. The central bank expects the economy to return to a moderate recovery path with supply-side constraints easing further and production regaining traction.

BoJ Governor, Masaaki Shirakawa warned on Wednesday that yen rises would hurt Japan’s economy in the short term, although he stuck to the view that growth would pick up as companies steadily restore their supply chains.

In Japanese economic news, yesterday, the industrial output increased by 6.2% (M-o-M) in May, higher than the initial estimate of a 5.7% increase. Additionally, on a seasonally adjusted monthly basis, the capacity utilization rose by 12.8% in May, following a 1.1% drop recorded in the previous month.

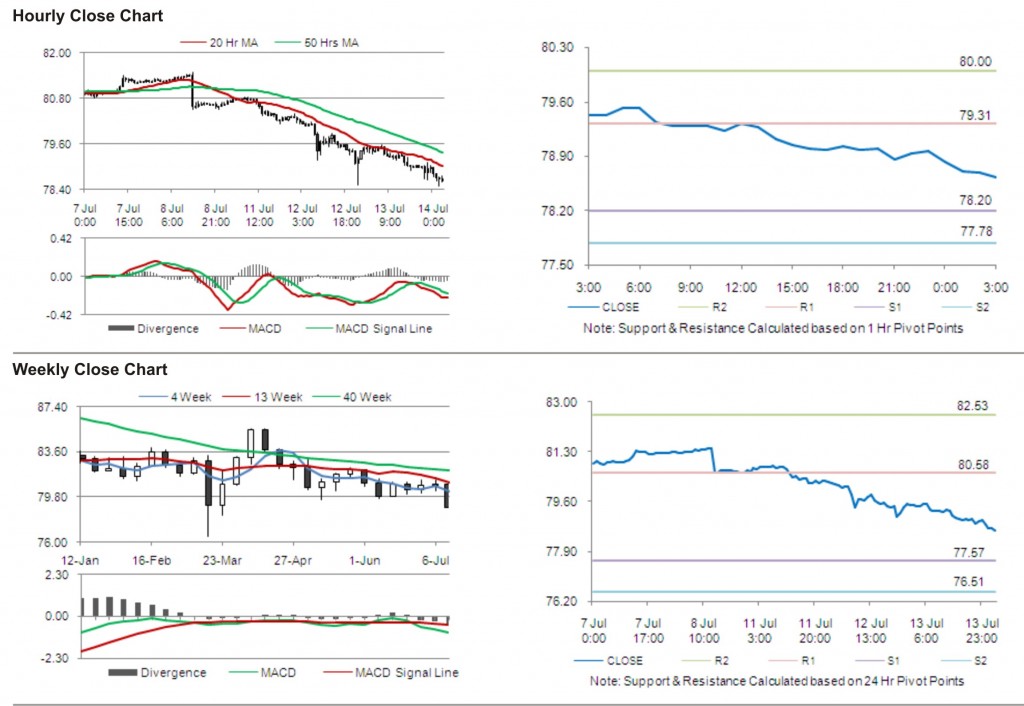

In the Asian session at 3:00GMT, the pair is trading lower from yesterday’s close at 23:00 GMT, by 0.43%, at 78.62.

The first short term resistance is at 79.31, followed by 80.00. The pair is expected to find support at 78.20 and the subsequent support level at 77.78.

Investors are eying Bank of Japan monetary policy meeting minutes to be released later today.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.