For the 24 hours to 23:00 GMT, EUR declined 1.21% against the USD and closed at 1.3910, after the European officials cut their forecasts for Euro-area economic growth.

The European Central Bank kept the key interest rate unchanged at 1.5%. Meanwhile, the rate on the marginal lending facility was retained at 2.25%, while the rate on the deposit facility was kept unchanged at 0.75%. The European Central Bank President, Jean-Claude Trichet indicated that the Euro-zone economy would grow moderately due to particularly high uncertainty and intensified downside risks. The central bank expects the annual real Gross Domestic Product (GDP) growth rate in the range of 1.4% to 1.8% for the current year, and between 0.4% and 2.2% in 2012.

Greenback also got a lift after the Federal Chairman Ben Bernanke offered no specific remarks indicating a third round of quantitative easing in September.

In the economic news, the current account surplus in Germany narrowed to €7.5 billion in July, compared to a current account surplus of €11.5 billion recorded in June. Meanwhile, the trade surplus declined to €10.4 billion in July, following a trade surplus of €12.7 billion recorded in June.

In the Asian session, at 3:00GMT, the EUR is trading at 1.3927, 0.12% higher against USD, from the levels yesterday at 23:00GMT.

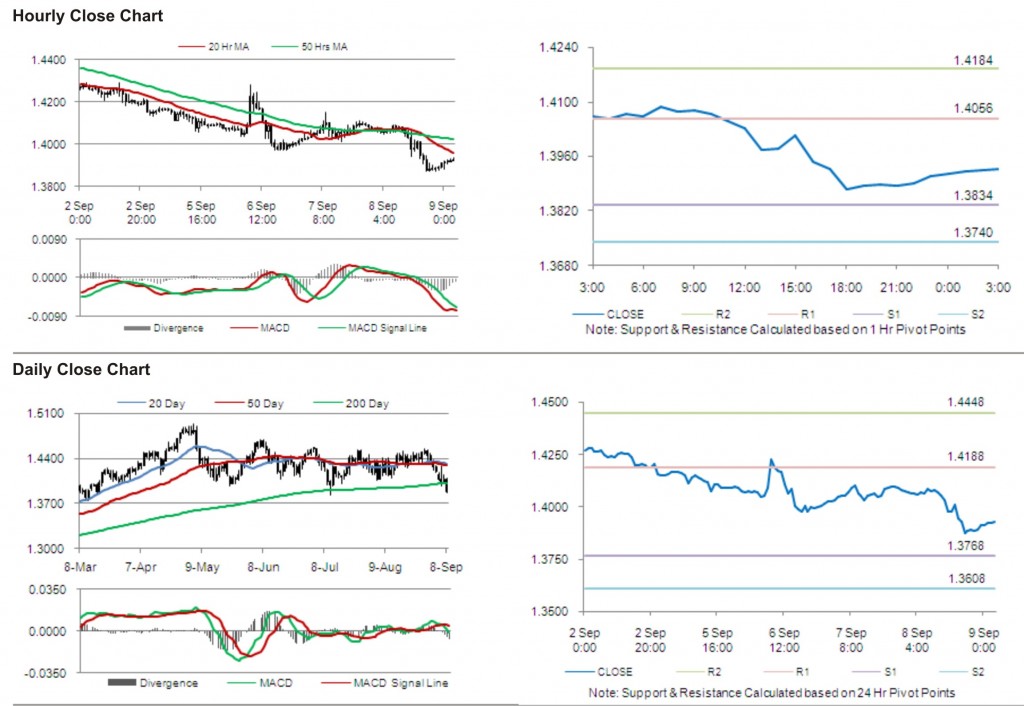

The pair has its first short term resistance at 1.4056, followed by the next resistance at 1.4184. The first support is at 1.3834, with the subsequent support at 1.3740.

Trading trends in the pair today are expected to be determined by release of Consumer Price Index (CPI) and Wholesale Price Index (WPI) in Germany.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.