For the 24 hours to 23:00 GMT, USD rose 0.42% against the CAD to close at 0.9881.

In the US, for the week ended 3 September 2011, initial jobless claims rose unexpectedly to 414,000, compared to the previous week’s revised figure of 412,000. For the week ended 27 August 2011, continuing claims fell to 3.717 million, compared to the preceding week’s revised level of 3.747 million. Additionally, the trade deficit narrowed to $44.8 billion in July, following a revised trade deficit of $51.6 billion recorded in June.

In Canada, the New Housing Price Index rose 0.1% (M-o-M) in July compared to a 0.3% increase in June. The building permits jumped up to 6.3% (M-o-M) in July, following a 2.8% increase in June. Additionally, trade deficit narrowed to C$753.0 million in July, following a trade deficit of C$1.4 billion recorded in June.

In the Asian session at 3:00GMT, USD is trading at 0.9876, slightly lower against the Canadian dollar from yesterday’s close at 23:00 GMT.

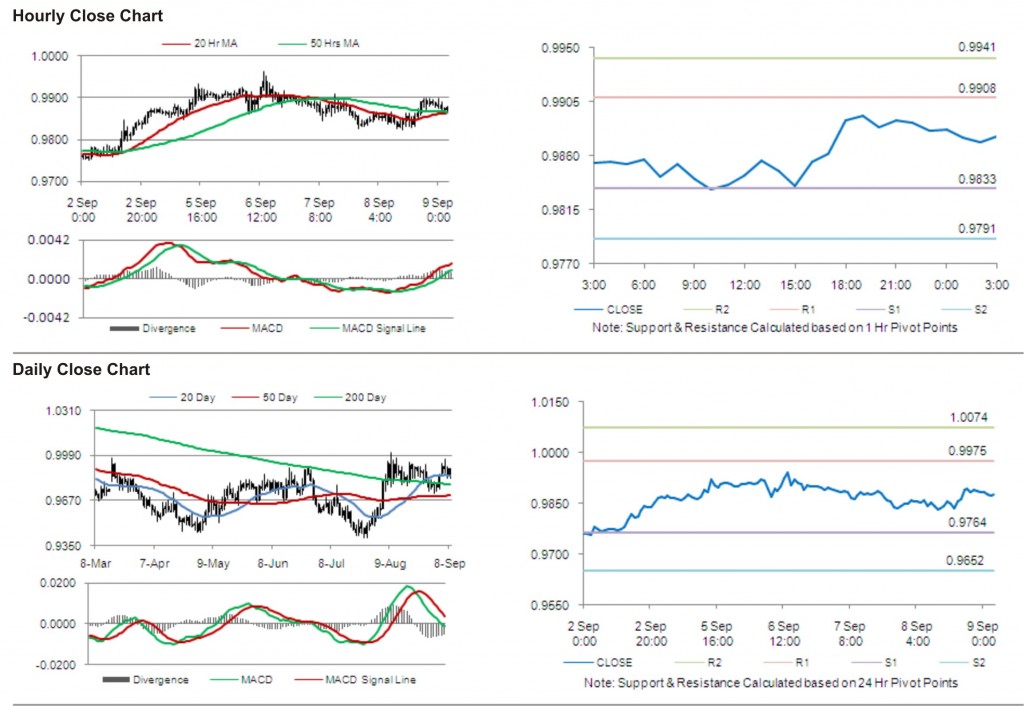

The first area of short term resistance is observed at 0.9908, followed by 0.9941 and 1.0016. The first area of support is at 0.9833, with the subsequent supports at 0.9791 and 0.9716.

With a series of Canada economic releases today, including unemployment rate and housing starts, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is showing convergence with its 20 Hr and its 50 Hr moving averages.