For the 24 hours to 23:00 GMT, the EUR rose 0.10% against the USD and closed at 1.3383.

In economic news, in Germany, Eurozone’s biggest economy, factory orders plunged at their fastest rate in nearly three years in June. Industrial orders unexpectedly slumped 3.2% in June, compared to market expectations for a rise of 0.9%. It had recorded a revised drop of 1.6% in the previous month. Adding to the Euro-zone’s woes, Italy’s economy contracted for the second quarter in a row in the three months to June. The GDP of Italy, Euro-zone’s third-largest economy, fell by a seasonally adjusted 0.2% in the Q2 of 2014, compared to a decline of 0.1% in the previous quarter. Markets had expected the GDP to rise 0.1% in the second quarter of 2014. On the other hand, industrial production in Italy rose more-than expected in June at a rate fastest in five months. The Italian industrial production index rose 0.9% in June, compared to a fall of 1.2% recorded in the previous month. Elsewhere, in Greece, its harmonized index of consumer prices fell 0.8% (Y-o-Y) at a slower pace in July. The HICP dropped 1.5% in May.

In the US, the number of mortgage applications climbed 1.6% on a weekly basis. The number of mortgage applications had declined 2.2% in the previous week. However, trade deficit in the US fell to $41.5 billion in June, compared to $ 44.7 billion in the previous month. Market anticipations were for the nation to post a trade deficit of $44.9 billion in June. Elsewhere, Atlanta Fed President, Dennis Lockhart, stated yesterday that he feels the first interest rate hike could come in mid-2015 or later.

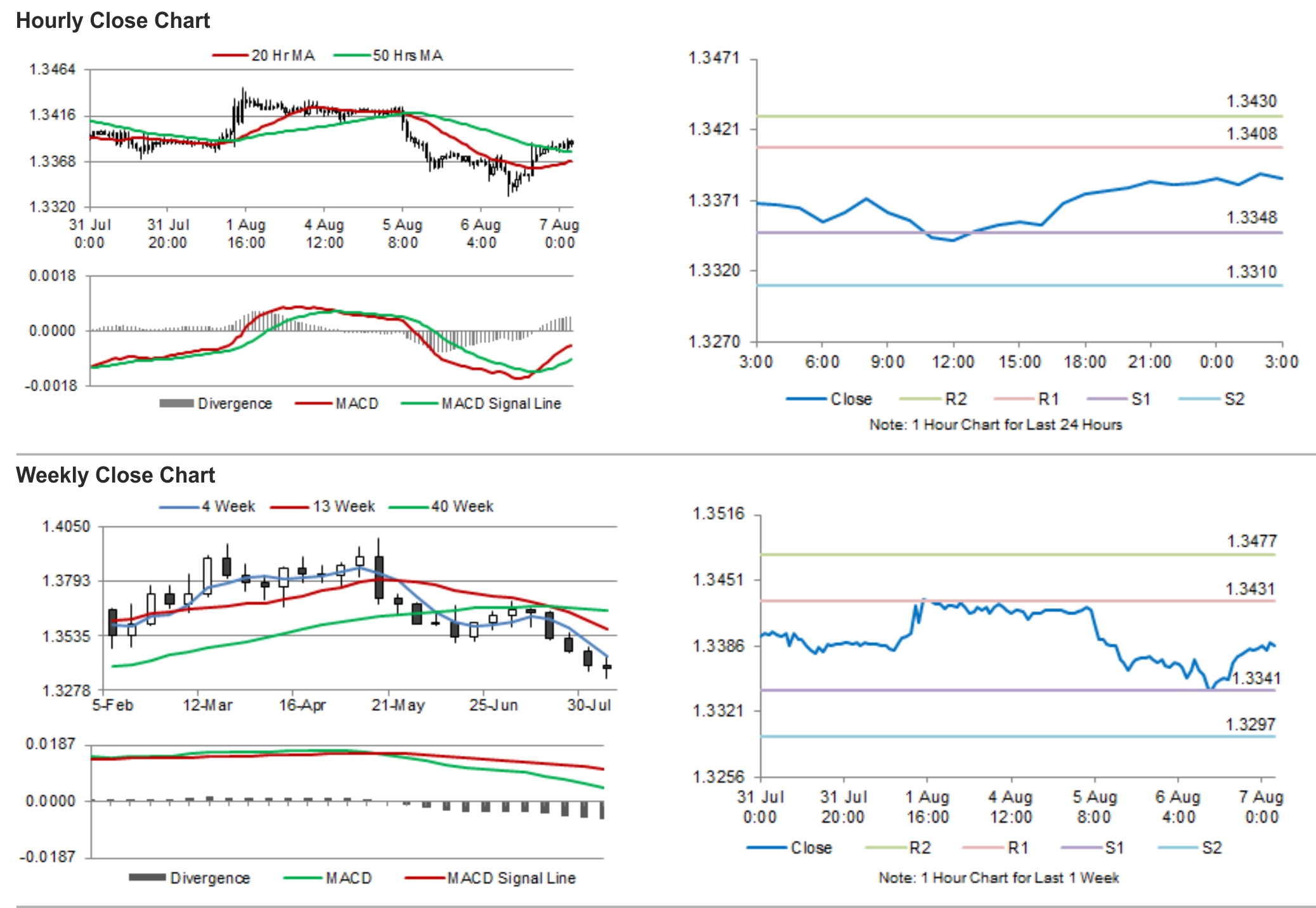

In the Asian session, at GMT0300, the pair is trading at 1.3386, with the EUR trading tad higher from yesterday’s close.

The pair is expected to find support at 1.3348, and a fall through could take it to the next support level of 1.3310. The pair is expected to find its first resistance at 1.3408, and a rise through could take it to the next resistance level of 1.3430.

Investors would be looking at Germany’s industrial production and ECB’s interest rate decision, scheduled ahead in the day. Meanwhile, today’s initial claims data from the US would gather investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving average.