For the 24 hours to 23:00 GMT, the GBP fell 0.17% against the USD and closed at 1.6852 after NIESR reported that UK’s GDP grew by 0.6% in the three months to July, making it the slowest rise in this year. Additionally, the UK industrial production rose 0.3% in June, on monthly basis, following a decline of 0.6% recorded in previous month. Similarly, on a monthly basis, manufacturing production in the UK rose 0.3% in June, compared to a decline of 1.3% registered a month earlier. Elsewhere, Halifax reported that the house prices in the UK recorded a rise of 1.4%, on a monthly basis, in July, compared to a drop of 0.4% in June and against market anticipations of a rise of 0.4%.

In the Asian session, at GMT0300, the pair is trading at 1.6854, with the GBP trading a tad higher from yesterday’s close.

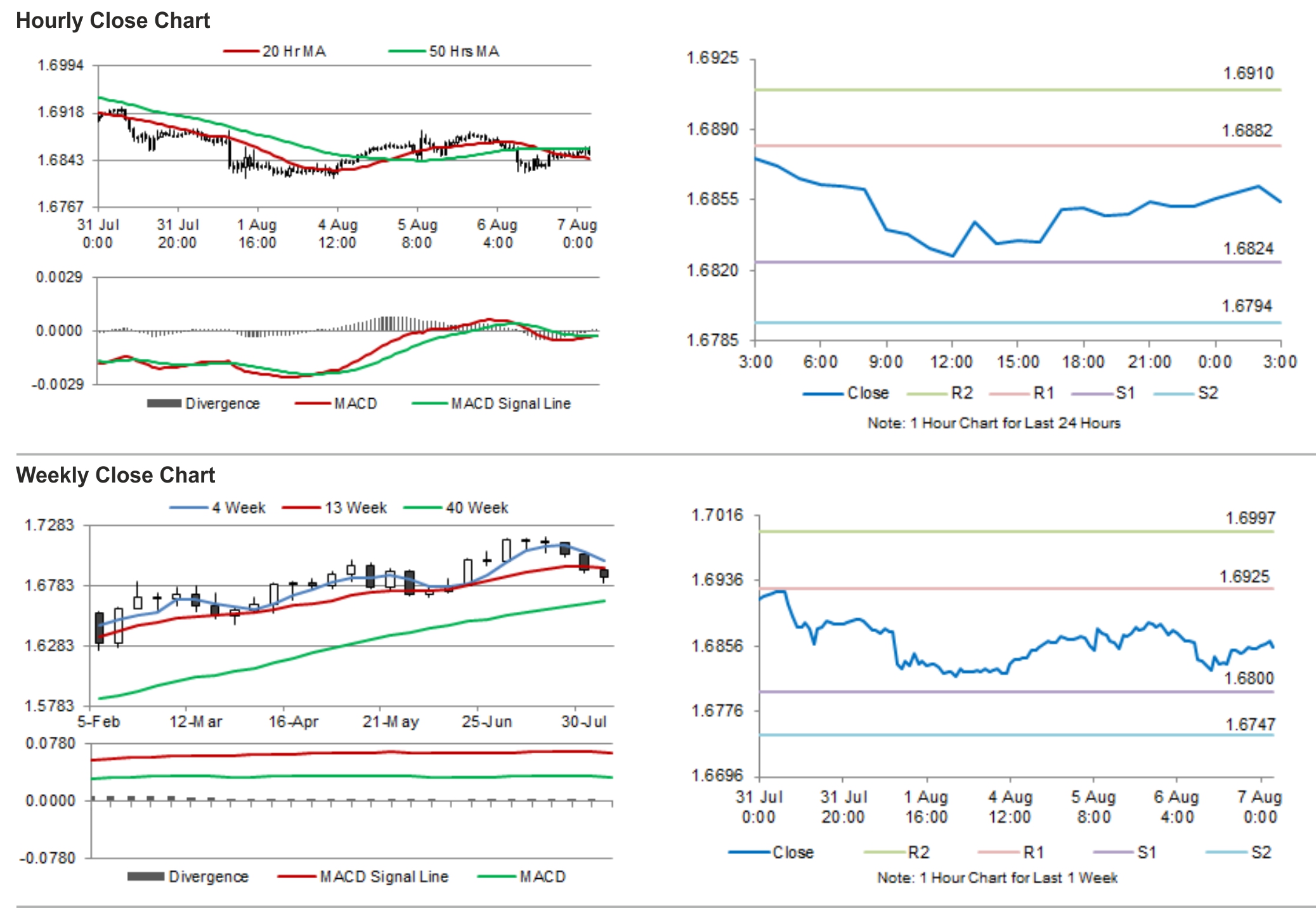

The pair is expected to find support at 1.6824, and a fall through could take it to the next support level of 1.6794. The pair is expected to find its first resistance at 1.6882, and a rise through could take it to the next resistance level of 1.691.

Going forward, investors today would be looking at the crucial BoE’s interest rate and its asset purchase target decision, scheduled just few hours from now.

The currency pair is trading above its 20 hr moving average and showing convergence with its 50 Hr moving average.