For the 24 hours to 23:00 GMT, the EUR declined 0.67% against the USD and closed at 1.1139, after the Euro-zone & German ZEW surveys reflected weakening economic sentiment.

Data showed that the Euro-zone’s economic sentiment index dropped to a level of 16.8 in May, from a reading of 21.5 in the previous month. Moreover, in Germany, the Euro-zone’s largest economy, the economic sentiment index unexpectedly deteriorated to a level of 6.4 in May, amid ongoing global economic concerns and worries over UK’s exit from the European Union. Markets were anticipating the index to climb to a level of 12.0, after registering a reading of 11.2 in the previous month. On the other hand, the nation’s current situation index rose more-than-anticipated to a level of 53.1 in May, compared to market expectations of a rise to a level of 49.0. In the prior month, the current situation index had registered a level of 47.7.

In other economic news, Germany’s seasonally adjusted final GDP rose in line with market expectations by 0.7% QoQ in 1Q 2016, helped by robust domestic demand, particularly in the construction sector. The preliminary figures had also indicated an advance of 0.7%, while in the previous quarter, GDP had climbed 0.3%.

The greenback gained ground, after robust US new home sales data supported the case of the Federal Reserve to raise rates in the near term.

Data indicated that US new home sales rebounded by 16.6% MoM in April, to over an eight-year high level of 619.0K, compared to a revised reading of 531.0K in the prior month. Market anticipation was for new home sales to drop to 523.0K. However, the nation’s Richmond Fed manufacturing index dropped to a level of -1.0 in May, from a reading of 14.0 in the previous month. Markets were anticipating the index to register a reading of 8.0.

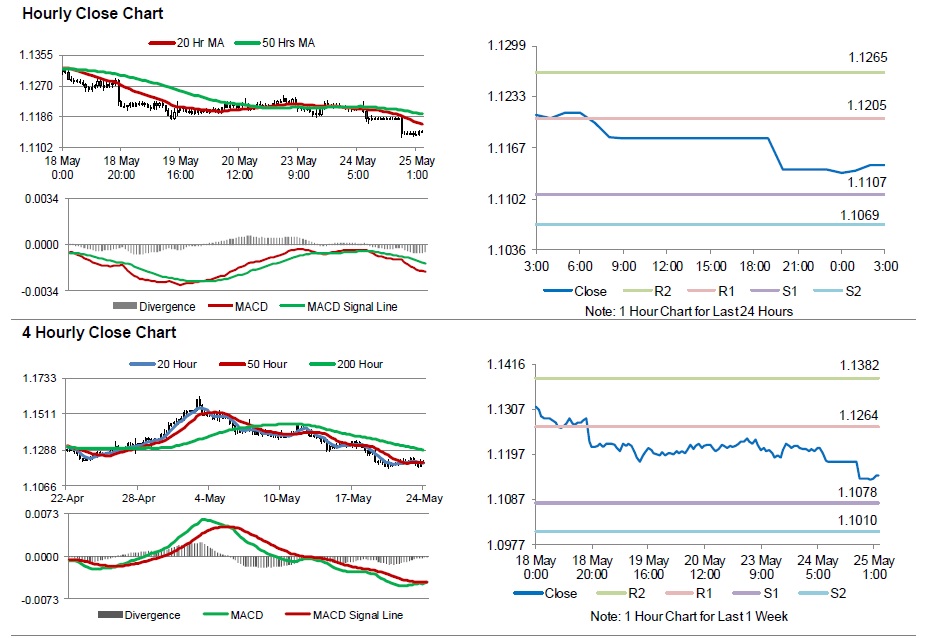

In the Asian session, at GMT0300, the pair is trading at 1.1145, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.1107, and a fall through could take it to the next support level of 1.1069. The pair is expected to find its first resistance at 1.1205, and a rise through could take it to the next resistance level of 1.1265.

Moving ahead, market participants will look forward to Germany’s Gfk consumer confidence index and the IFO business survey data, scheduled to release in a few hours. Moreover, the US Markit services PMI, advance goods trade balance and housing price index data, will also grab investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.