For the 24 hours to 23:00 GMT, the GBP rose 1.02% against the USD and closed at 1.4628, after a fresh poll indicated renewed support for Britain to stay in the European Union, thus easing Brexit worries.

In economic news, UK’s public account deficit widened more-than-expected to £6.6 billion in April, compared to a revised deficit of £6.1 billion in the prior month. Markets were expecting it to report a deficit of £5.8 billion. On the other hand, the nation’s CBI distributive trade survey’s retail sales balance rebounded to a level of 7.0 in May, from a reading of -13.0 in the previous month and against investor expectations for rise to a level of 8.0.

In the Asian session, at GMT0300, the pair is trading at 1.4610, with the GBP trading 0.12% lower from yesterday’s close.

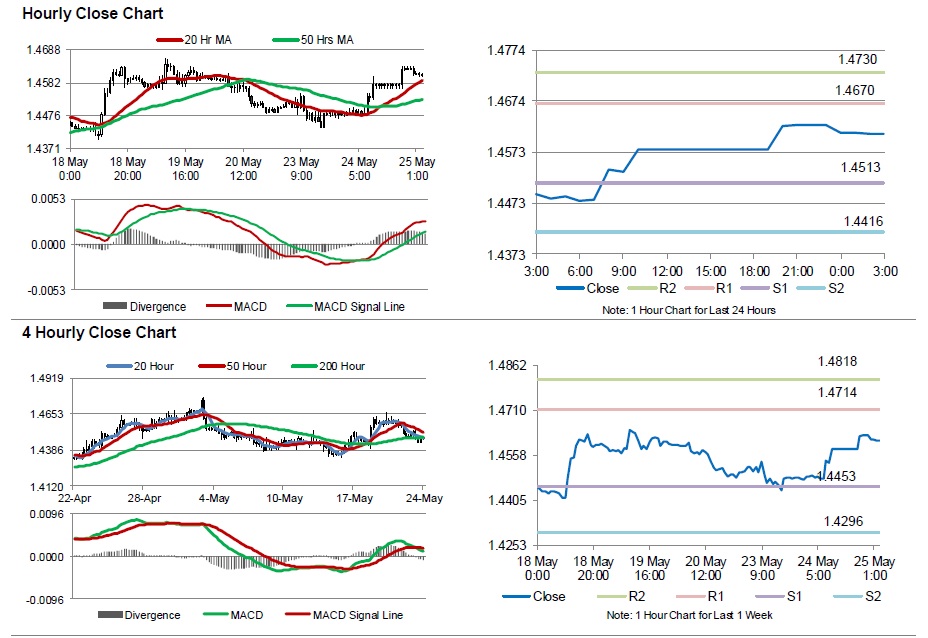

The pair is expected to find support at 1.4513, and a fall through could take it to the next support level of 1.4416. The pair is expected to find its first resistance at 1.4670, and a rise through could take it to the next resistance level of 1.4730.

Amid no economic releases in UK today, investors will look forward to the nation’s Q1 flash GDP and BBA mortgage approvals data for April, scheduled to release tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.