For the 24 hours to 23:00 GMT, the EUR declined 0.32% against the USD and closed at 1.1148, following the European Central Bank’s (ECB) cautious economic outlook.

Yesterday, the ECB left the key interest rate unchanged at a record low zero percent, as widely expected. Further, although the ECB nudged up its inflation forecast for 2016, it predicted price growth would remain below target through 2018 as depressed energy costs have held down prices of other goods and services. The central bank raised its inflation outlook for 2016 to 0.2%, from 0.1% previously, while forecasting an economic growth of 1.6%, up from 1.4%.

In other economic news, the Euro-zone’s producer price index (PPI) dropped by 0.3% MoM in April, its fastest annual drop since late 2009, thus underlining the ECB’s difficulty in trying to boost inflation. Investors had expected an advance of 0.1%, following a 0.3% rise in the previous month.

The greenback gained ground after the US private sector employment rose 173.0K in May, following a revised gain of 166.0K in the previous month. Moreover, the nation’s initial jobless claims dropped unexpectedly to a level of 267.0K in the week ended 28 May 2016, compared to a reading of 268.0K in the previous week. Market expectation was for initial jobless claims to rise to a level of 270.0K.

Separately, the Dallas Federal Reserve (Fed) President, Robert Kaplan, reiterated his belief that the Fed should move quickly to raise rates as the economy is showing signs of sustained recovery while inflation is accelerating.

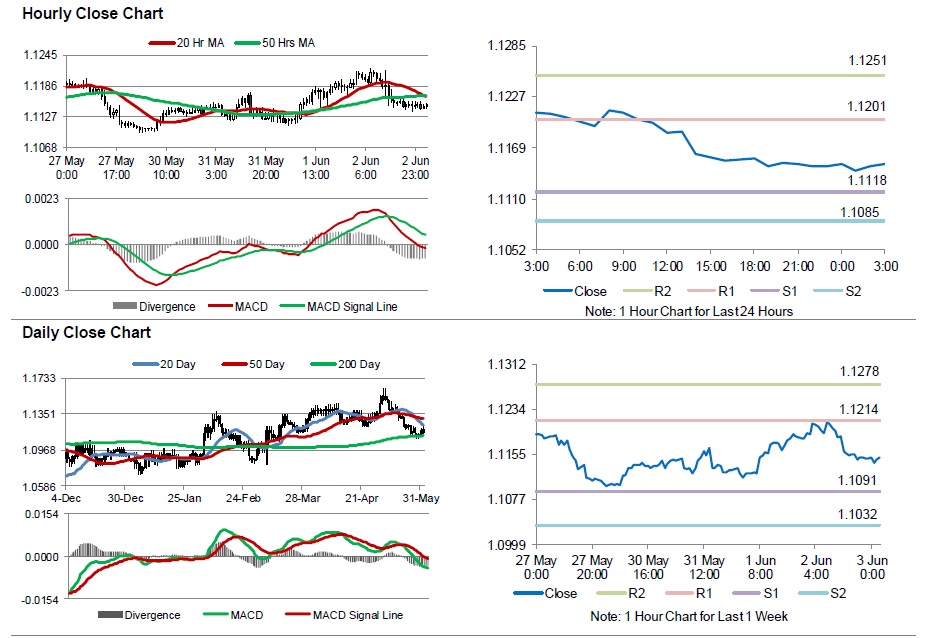

In the Asian session, at GMT0300, the pair is trading at 1.1150, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.1118, and a fall through could take it to the next support level of 1.1085. The pair is expected to find its first resistance at 1.1201, and a rise through could take it to the next resistance level of 1.1251.

Going ahead, investors will look forward to the Markit services PMI for May across the Euro-zone, scheduled to release in a few hours. Moreover, the US nonfarm payrolls and Markit services PMI data, both for the month of May, will attract market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.