For the 24 hours to 23:00 GMT, the GBP marginally fell against the USD and closed at 1.4411, after UK’s construction PMI unexpectedly declined to a level of 51.2 in May, as output growth fell to its weakest level in almost three years and incoming new work dropped for the first time since April 2013. Investors had expected it to remain steady at a level of 52.0.

In the Asian session, at GMT0300, the pair is trading at 1.44, with the GBP trading 0.08% lower from yesterday’s close.

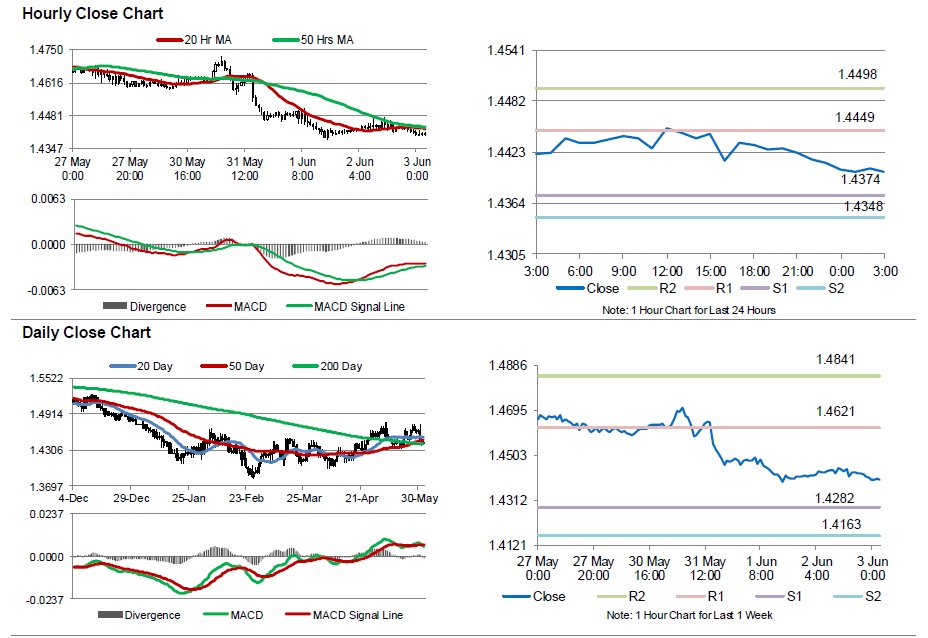

The pair is expected to find support at 1.4374, and a fall through could take it to the next support level of 1.4348. The pair is expected to find its first resistance at 1.4449, and a rise through could take it to the next resistance level of 1.4498.

Moving ahead, market participants will look forward to Britain’s Markit services PMI data for May, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.