For the 24 hours to 23:00 GMT, the EUR rose 0.67% against the USD and closed at 1.1268, as investors shrugged off Germany’s downbeat factory orders data.

Data revealed that the German factory orders unexpectedly fell 1.8% MoM in August, after a revised 2.2% drop in July, led by a slowdown in China and other emerging markets. The nation’s factory orders were expected to rise 0.5%. Meanwhile, the German retail PMI came in at a level of 54.0 in September, from a reading of 54.7 in the previous month. Also Germany’s Markit construction PMI rose to a level of 52.4 in September, from a reading of 50.3 in August, growing at its fastest pace in six months.

Other macroeconomic data indicated that the Euro-zone’s retail PMI rose to a reading of 51.9 in September, reaching is second-strongest reading since April 2011, from 51.4 in August.

In the US, trade deficit widened more than anticipated to $48.3 billion in August, its worst since March, from a revised level of $41.8 billion in July, as exports fell amid a slowing global economy, thus imposing further caution on the Fed’s plan to increase interest rates this year.

Meanwhile, the San Francisco Fed President, John Williams, stated that the Federal Reserve should communicate its views of an interest-rate hike well enough so that markets are not taken by surprise.

Separately, the IMF downgraded its global growth forecast for 2015 by 0.2% to 3.1%, compared to its previous estimate of 3.3% in July, citing the economic slowdown in China and its likely spill over on other emerging markets. However, it expects global growth to pick up 3.6% in 2016, but less than its earlier projection of 3.8% growth

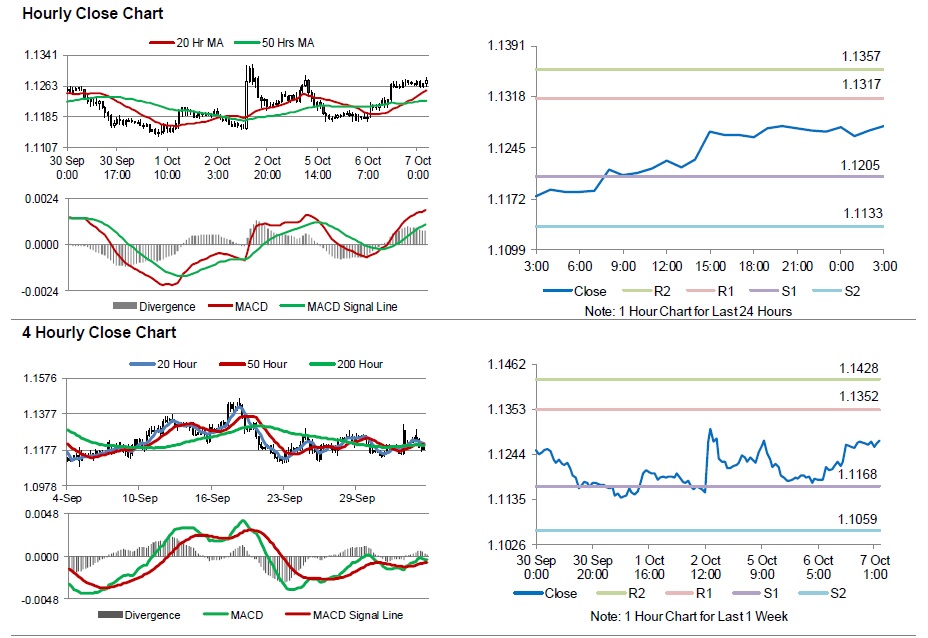

In the Asian session, at GMT0300, the pair is trading at 1.1277, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.1205, and a fall through could take it to the next support level of 1.1133. The pair is expected to find its first resistance at 1.1317, and a rise through could take it to the next resistance level of 1.1357.

Going ahead, market participants will look forward to the release of Germany’s industrial production data, scheduled in a few hours. In addition to this, the US MBA mortgage applications data, due later in the day, is also expected to fetch investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.