For the 24 hours to 23:00 GMT, the GBP rose 0.54% against the USD and closed at 1.5229.

Data showed that, British house prices fell 0.9% MoM in September, reaching its lowest level in a year, from a 2.7% rise in August.

Yesterday, the IMF remained positive on its growth prospects for the UK. The agency forecasted the country’s economy to grow at 2.5% in 2015, up from 2.4% in July and kept its prediction unchanged for a growth of 2.2% in 2016.

In the Asian session, at GMT0300, the pair is trading at 1.5246, with the GBP trading 0.11% higher from yesterday’s close.

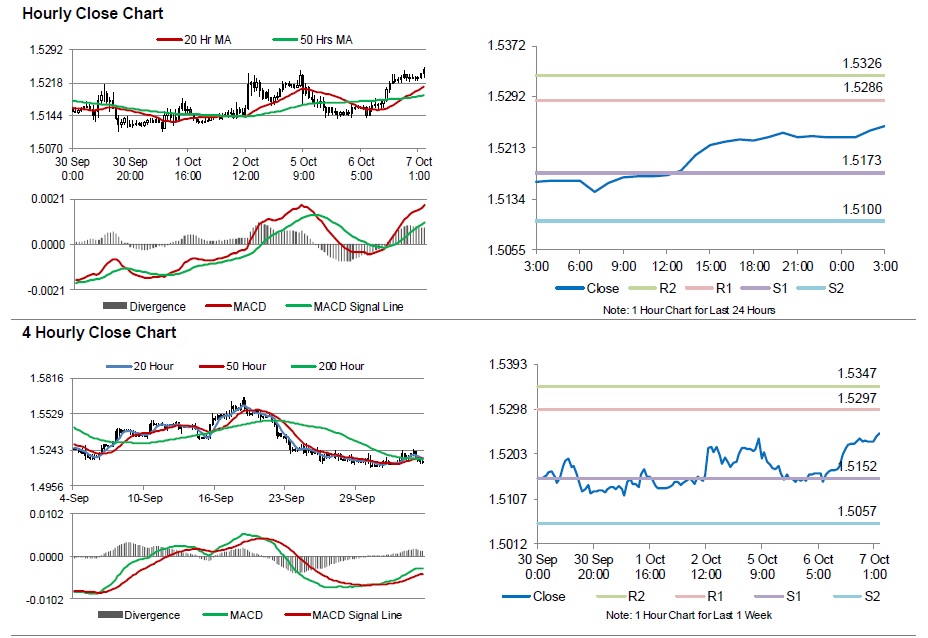

The pair is expected to find support at 1.5173, and a fall through could take it to the next support level of 1.5100. The pair is expected to find its first resistance at 1.5286, and a rise through could take it to the next resistance level of 1.5326.

Going ahead, market participants will concentrate on Britain’s industrial production, manufacturing production, and the NIESR’s GDP estimate data, scheduled to be released today, for further cues.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.