For the 24 hours to 23:00 GMT, the EUR declined 0.21% against the USD and closed at 1.1098, after a Bloomberg report hinted at more European Central Bank (ECB) easing.

In economic news, the Euro-zone’s consumer price index (CPI) surprisingly rose by 0.1% YoY in June, rising for the first time in five months, indicating that the ECB’s efforts to fight deflation was beginning to have some effect on the economy. Meanwhile in Germany, retail sales advanced above expectations by 0.90% MoM in May, following a revised drop of 0.3% in the prior month. Moreover, the nation’s seasonally adjusted unemployment rate remained steady at an all-time low level of 6.1% in June.

In the US, initial jobless claims advanced to a level of 268.0 K in the week ended 25 June 2016, compared to a revised reading of 258.00 K in the prior week. On the other hand, the nation’s Chicago Fed purchasing managers’ index rose more-than-expected to a level of 56.8 in June, from a reading of 49.3 in the previous month.

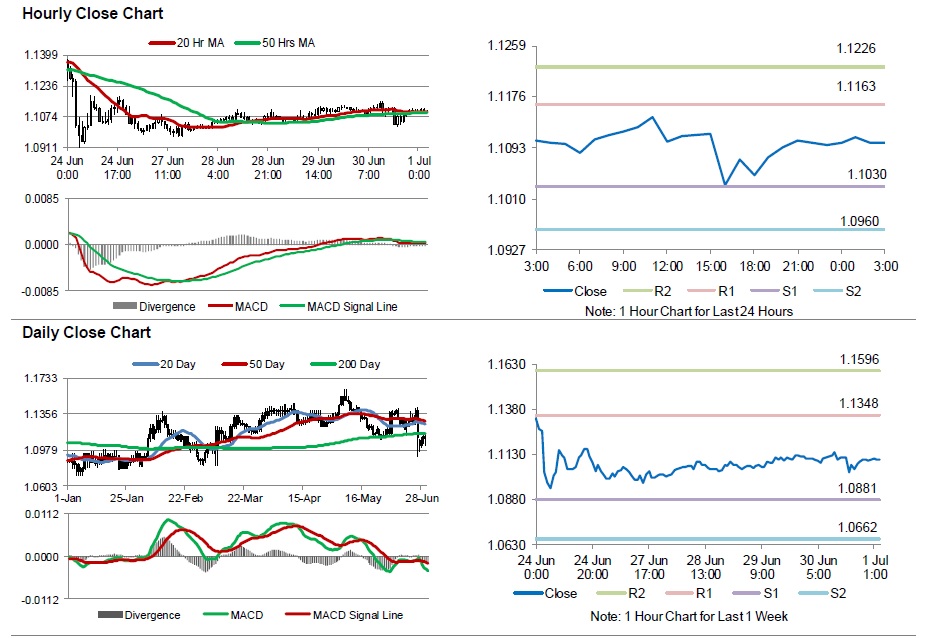

In the Asian session, at GMT0300, the pair is trading at 1.1101, with the EUR trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1030, and a fall through could take it to the next support level of 1.0960. The pair is expected to find its first resistance at 1.1163, and a rise through could take it to the next resistance level of 1.1226.

Going ahead, investors will look forward to the Markit manufacturing PMI data across the Euro-zone, scheduled to release in a few hours. Moreover, the US Markit manufacturing PMI and construction spending data, due later today, will garner market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.