For the 24 hours to 23:00 GMT, the GBP fell 1.00% against the USD and closed at 1.3314, after the Bank of England (BoE) Governor, Mark Carney, indicated that the central bank might ease monetary policy further in order to combat an expected economic slowdown, following UK’s plan to leave the European Union (EU). Nevertheless, he expressed confidence in UK’s ability to adapt to a future outside the EU.

In other economic news, UK’s final reading of GDP advanced in line with market expectations by 0.4% QoQ in 1Q 2016, unrevised from its previous estimate. On the other hand, the nation’s current account deficit narrowed less-than-expected to £32.6 billion in 1Q 2016, compared to a revised current account deficit of £34.0 billion in the previous quarter.

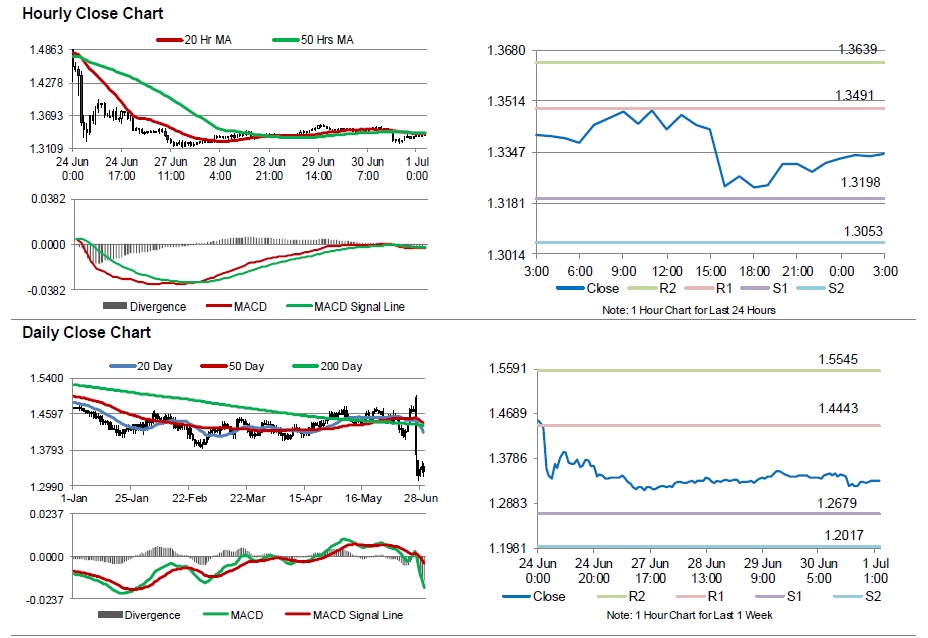

In the Asian session, at GMT0300, the pair is trading at 1.3342, with the GBP trading 0.21% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3198, and a fall through could take it to the next support level of 1.3053. The pair is expected to find its first resistance at 1.3491, and a rise through could take it to the next resistance level of 1.3639.

Going ahead, investors will look forward to UK’s Markit manufacturing PMI data for June, scheduled to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.