For the 24 hours to 23:00 GMT, the EUR declined 0.45% against the USD and closed at 1.1650.

In the US, data showed that CB consumer confidence index eased to a level of 126.4 in June, suggesting a slowdown in future business conditions and income outlook. The index had registered a revised level of 128.8 in the previous month while market participants had expected for a fall to a level of 128.0. On the other hand, the Richmond Fed manufacturing index unexpectedly climbed to a level of 20.0 in June, defying market consensus for a drop to a level of 15.0. In the prior month the index had recorded a reading of 16.0.

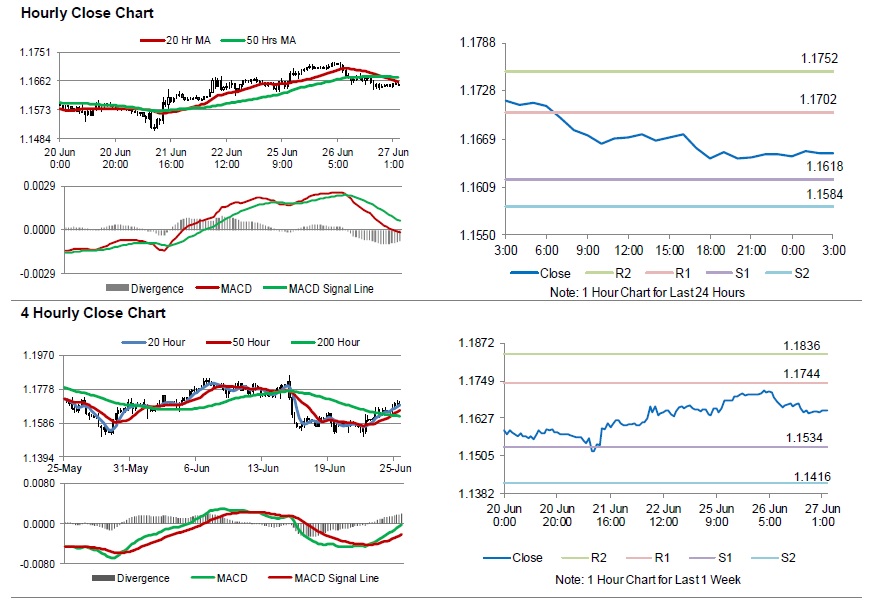

In the Asian session, at GMT0300, the pair is trading at 1.1651, with the EUR trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1618, and a fall through could take it to the next support level of 1.1584. The pair is expected to find its first resistance at 1.1702, and a rise through could take it to the next resistance level of 1.1752.

Amid lack of key economic releases in the Euro-zone today, investor sentiment would be determined by the US advance goods trade balance, pending home sales and durable goods orders, all for May, set to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.