For the 24 hours to 23:00 GMT, the GBP declined 0.44% against the USD and closed at 1.3224.

Macroeconomic data revealed that UK’s BBA mortgage approvals unexpectedly climbed to a 4-month high level of 39.2K in May, compared to market expectations for a fall to a level of 38.3K. The BBA mortgage approvals had recorded a revised reading of 38.3K in the prior month.

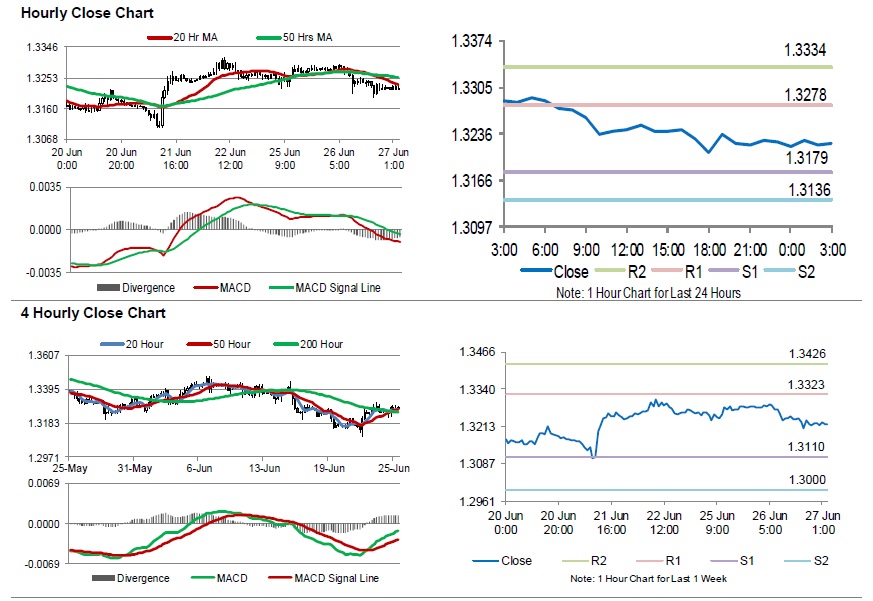

In the Asian session, at GMT0300, the pair is trading at 1.3221, with the GBP trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3179, and a fall through could take it to the next support level of 1.3136. The pair is expected to find its first resistance at 1.3278, and a rise through could take it to the next resistance level of 1.3334.

Moving ahead, investors will keep an eye on UK’s Nationwide house price index for June, due to be released in a while. Also, the Bank of England Governor, Mark Carney’s speech will garner significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.