For the 24 hours to 23:00 GMT, the EUR rose 0.31% against the USD and closed at 1.1188.

The US Dollar lost ground against its major peers, after the US Federal Reserve (Fed), in its recent monetary policy meeting, held the target rate for overnight lending between banks in a range of 0.25% and 0.50%, amid low inflation and uninspiring economic growth in the US. However, the central bank strongly signalled that the case for an interest rate hike by the end of this year has strengthened as the labour market improves further. The bank also reduced its longer-run interest rate forecast to 2.9% from 3.0%.

In a statement post the meeting, the Fed Chair, Janet Yellen, pointed out that the US economy is on the growth track, as the pace of economic activity had picked up from the modest growth seen in the first half of 2016 and also noted that further tightening of monetary policy would be needed to keep the economy from overheating and fuelling high inflation. Separately, in its summary of economic projections, the Fed policymakers slashed the US growth forecast to 1.8% for 2016, from 2.0% estimated earlier in June.

Meanwhile, the global leading think tank, Organisation for Economic Co-operation and Development (OECD) cut its global economic outlook for 2016, as growth remains subdued in major economies, amid sluggish trade activity and also citing the effects of Britain’s vote to leave the European Union. It now expects the global economy to expand by 2.9% this year, down from 3.0% predicted in June.

In the Asian session, at GMT0300, the pair is trading at 1.1187, with the EUR trading marginally lower against the USD from yesterday’s close.

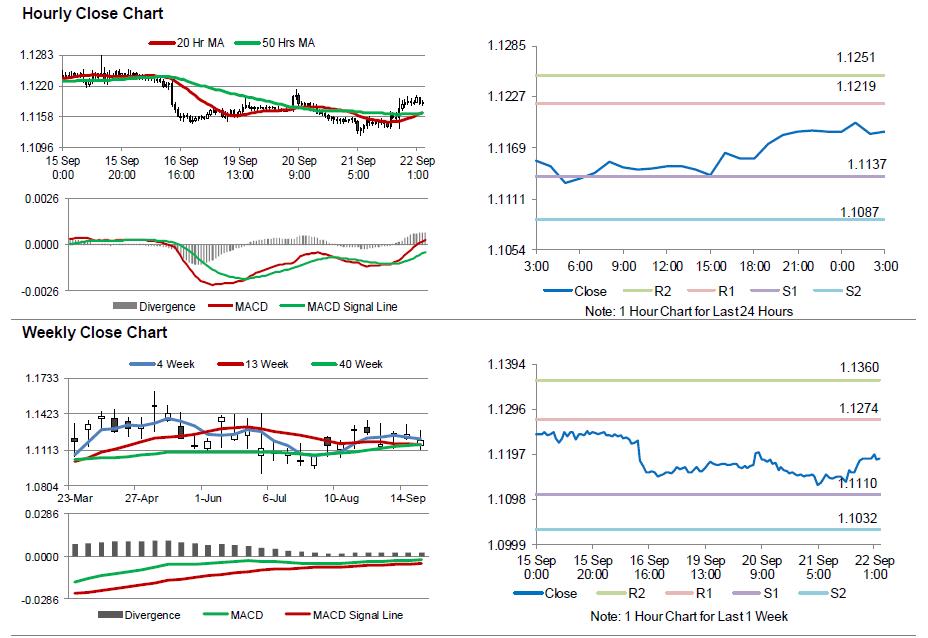

The pair is expected to find support at 1.1137, and a fall through could take it to the next support level of 1.1087. The pair is expected to find its first resistance at 1.1219, and a rise through could take it to the next resistance level of 1.1251.

Moving ahead, market participants look forward to the ECB President, Mario Draghi’s speech along with the central bank’s economic bulletin report and the Euro zone consumer confidence data, all due to release today. Moreover, in the US, initial jobless claims, existing home sales and housing price index, all slated to release later today, would garner a lot of investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.