For the 24 hours to 23:00 GMT, the GBP rose 0.34% against the USD and closed at 1.3031.

Yesterday, the Organisation for Economic Co-operation and Development (OECD) stated that Brexit is likely to hit the UK economy later, but harder than originally expected and also slashed its UK economic growth forecast to 1.0% in 2017, from the earlier June forecast of 2.0%.

Separately, the Bank of England (BoE), in its quarterly bulletin report, highlighted that businesses were apparently slowing down on making investments and that employment would likely be flat over the coming year due to Britain’s decision to leave the European Union.

In other economic news, UK’s public sector net borrowing posted a less-than-expected deficit of £10.1 billion in August, following a revised surplus of £2.4 billion in the prior month and compared to market anticipation for a deficit of £10.3 billion.

In the Asian session, at GMT0300, the pair is trading at 1.3044, with the GBP trading 0.1% higher against the USD from yesterday’s close.

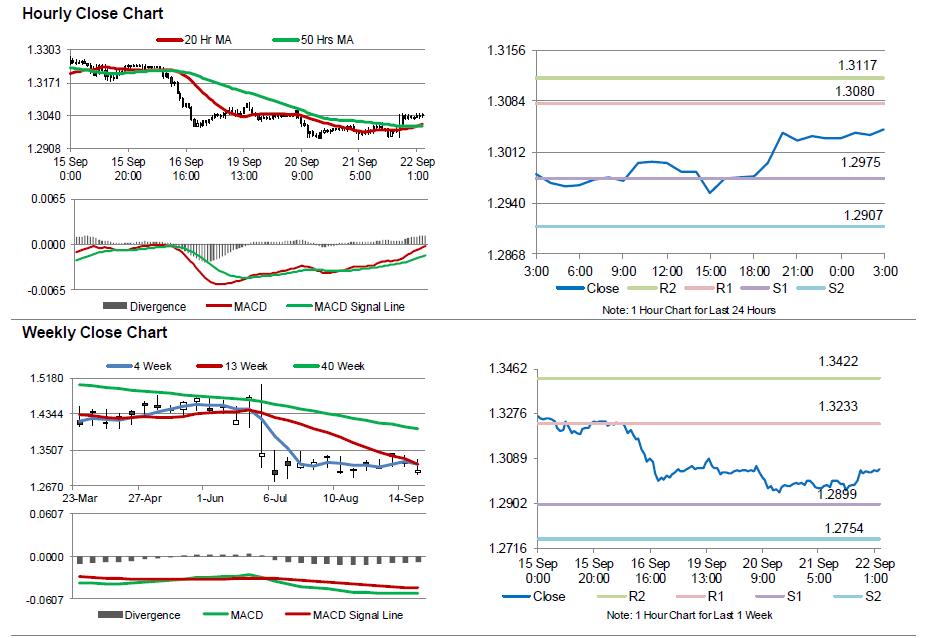

The pair is expected to find support at 1.2975, and a fall through could take it to the next support level of 1.2907. The pair is expected to find its first resistance at 1.3080, and a rise through could take it to the next resistance level of 1.3117.

Going ahead, today investors would look forward to UK’s CBI industrial trends orders survey for September along with a speech by the BoE Governor, Mark Carney.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.