For the 24 hours to 23:00 GMT, the EUR declined 0.45% against the USD and closed at 1.1777.

Yesterday, data showed that the wholesale price index in Germany recorded a drop of 1.0% on a MoM basis in December. The index had fallen 0.7% in the prior month.

Elsewhere, in Italy, industrial production rose 0.3% on a monthly basis in November, compared to a revised flat reading in the prior month. Market expectations were for industrial production to rise 0.1%.

In the US, the NFIB small business optimism index rose to a level of 100.4 in December, compared to market expectations of an advance to a level of 98.5. Additionally, the nation’s JOLTs job openings advanced to 4972.0 K in November, following a revised level of 4830.0 K recorded in October. Meanwhile, the IBD/TIPP economic optimism index climbed unexpectedly to 51.5 in January, compared to market expectations of a drop to a level of 48.3. Also, the nation reported a budget surplus of $1.9 billion in December, following a budget deficit of $56.82 billion in the previous month. Markets were anticipating a budget surplus of $3.0 billion.

Separately, the Minneapolis Fed President Narayana Kocherlakota, called for more monetary stimulus measures, stating that the US central bank should adopt a goal oriented approach to boost employment and achieve the 2% inflation target.

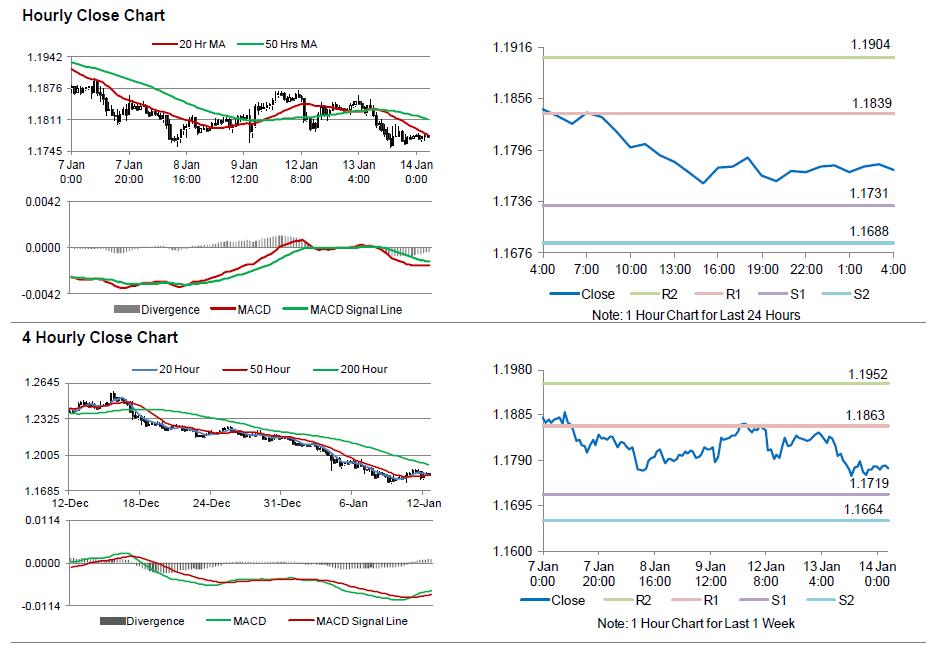

In the Asian session, at GMT0400, the pair is trading at 1.1774, with the EUR trading a tad lower from yesterday’s close.

Earlier today, the World Bank slashed its forecast for global growth in 2015 to 3%, down from a 3.2% estimation in October, due to disappointing economic prospects in the Euro-zone, Japan and some major developing economies. Additionally, it also increased its economic growth forecasts for the US to 3.2% from 3% projected earlier, while downgrading the Euro-zone’s growth prospect to 1.1% from 1.8%.

The pair is expected to find support at 1.1731, and a fall through could take it to the next support level of 1.1688. The pair is expected to find its first resistance at 1.1839, and a rise through could take it to the next resistance level of 1.1904.

Trading trends in the pair today are expected to be determined by the US advance retail sales data, scheduled later today.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.