For the 24 hours to 23:00 GMT, the GBP traded a tad lower against the USD and closed at 1.5163, after Britain’s inflation slipped to a record low on an annual basis in December, thus diminishing expectations of an interest rate hike by the UK central bank anytime soon.

The consumer price inflation in the UK tumbled more than expected to a 14-year low of 0.5% on an annual basis in December, following a level of 1.0% recorded in November. Markets were expecting it to drop to 0.7%

In other news, the UK’s DCLG house price index registered a rise of 10.0% on a YoY basis in November, higher than market forecasts for a 9.8% increase. The index had climbed 10.4% in the prior month

In the Asian session, at GMT0400, the pair is trading at 1.5153, with the GBP trading 0.07% lower from yesterday’s close.

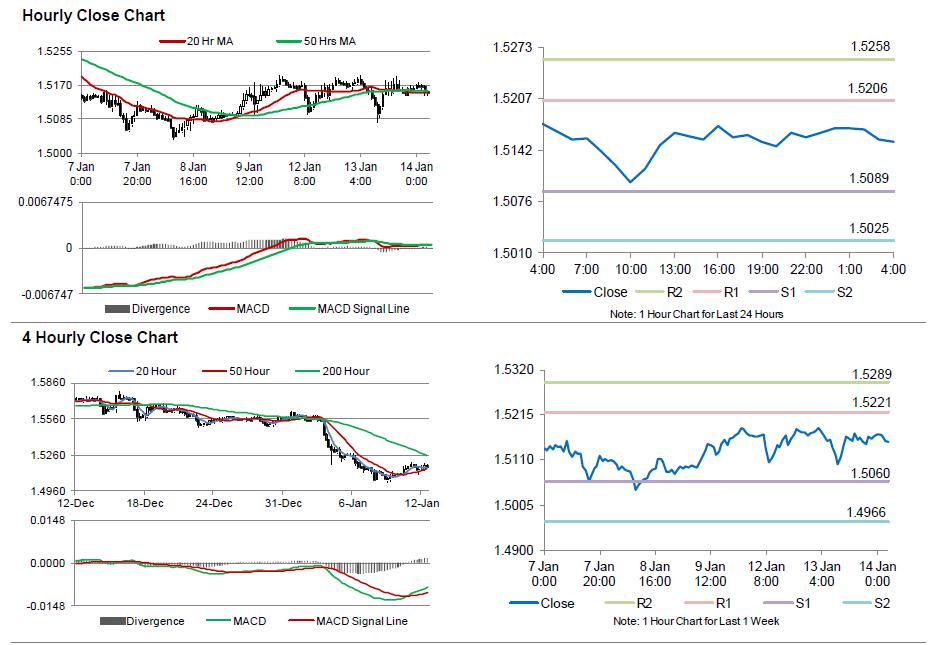

The pair is expected to find support at 1.5089, and a fall through could take it to the next support level of 1.5025. The pair is expected to find its first resistance at 1.5206, and a rise through could take it to the next resistance level of 1.5258.

Trading trends in the Pound today are expected to be determined by the BoE Governor, Mark Carney’s crucial speech, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.