For the 24 hours to 23:00 GMT, the EUR rose 0.89% against the USD and closed at 1.1318, after the Euro-zone’s consumer price inflation rose more-than-anticipated by 0.2% MoM in February, compared to a drop of 1.4% in the previous month, and against investor expectations for a rise of 0.1%. Additionally, the Euro-zone’s seasonally adjusted trade surplus narrowed to a 3-month low level of €21.2 billion in January, compared to a revised trade surplus of €21.5 billion in the previous month. Market anticipation was for the region’s trade surplus to drop to €19.5 billion.

In the US, seasonally adjusted initial jobless claims recorded a rise to 265.0K in the week ended 12 March 2016, compared to market expectations of an advance to a level of 268.0K. Initial jobless claims had recorded a revised level of 258.0K in the previous week. Moreover, the nation’s Philadelphia Fed manufacturing index surprisingly rose to a 13-month high level of 12.4 in March, compared to a level of -2.8 in the previous month and compared to investor expectations of it to register a reading of -1.5.

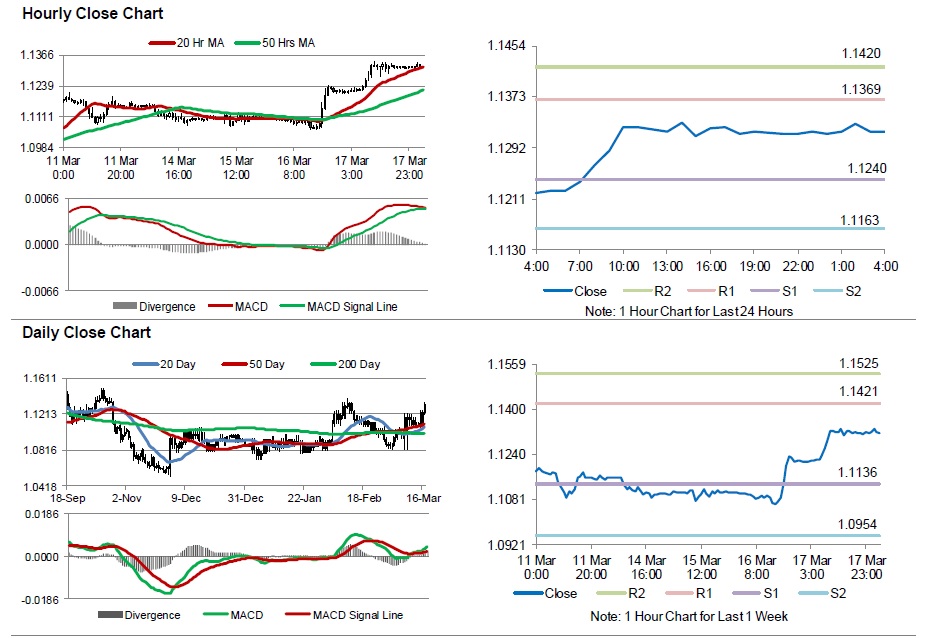

In the Asian session, at GMT0400, the pair is trading at 1.1318, with the EUR trading flat from yesterday’s close.

The pair is expected to find support at 1.1240, and a fall through could take it to the next support level of 1.1163. The pair is expected to find its first resistance at 1.1369, and a rise through could take it to the next resistance level of 1.1420.

Moving ahead, market participants will look forward to the US flash Reuters/Michigan consumer sentiment index for March, scheduled to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.