For the 24 hours to 23:00 GMT, the GBP rose 1.57% against the USD and closed at 1.4472.

Yesterday, the Bank of England’s (BoE) monetary policy committee unanimously voted to keep the key interest rate at a historic low of 0.5% and maintained its quantitative easing asset purchase programme at £375.0 billion. Further, the minutes of the central bank’s March meeting indicated that growing uncertainty surrounding Britain’s referendum on its European Union membership has weighed on the Pound and might also delay investment and economic growth in the nation.

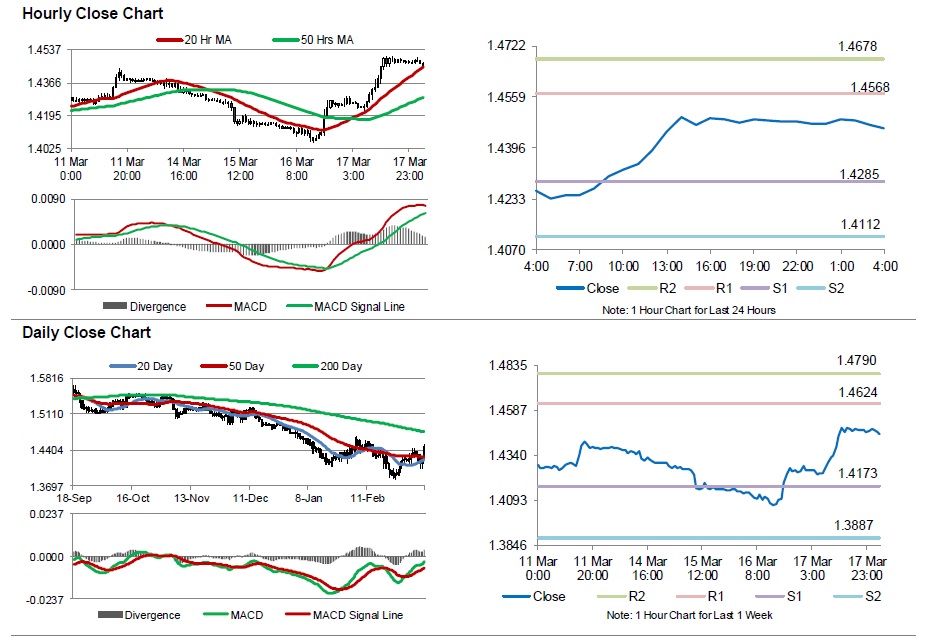

In the Asian session, at GMT0400, the pair is trading at 1.4459, with the GBP trading 0.09% lower from yesterday’s close.

The pair is expected to find support at 1.4285, and a fall through could take it to the next support level of 1.4112. The pair is expected to find its first resistance at 1.4568, and a rise through could take it to the next resistance level of 1.4678.

Moving ahead, investors will look forward to the UK’s consumer price inflation, public sector net borrowing and retail sales data, all scheduled to release next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.