For the 24 hours to 23:00 GMT, the EUR rose 0.32% against the USD and closed at 1.0757.

Macroeconomic data indicated that, Germany’s seasonally adjusted industrial production rebounded less-than-expected by 0.3% on a monthly basis in October, suggesting that industrial sector got off to a weak start heading into the fourth quarter. Markets expected industrial production to gain 0.8%, following a revised drop of 1.6% in the previous month.

In economic news, data indicated that mortgage applications in the US fell 0.7% in the week ended 02 December 2016, after recording a decline of 9.4% in the previous week. Further, the nation’s JOLTs job openings dropped less-than-anticipated to a level of 5534.0K in October, compared to a revised reading of 5631.0K in the previous month, while markets expected it to fall to a level of 5500.0K. On the other hand, the nation’s consumer credit advanced less-than-expected by $16.0 billion in October, marking its slowest rate of increase in 4-months, against a revised rise of $21.8 billion in the previous month and compared to investor consensus for a rise of $18.7 billion.

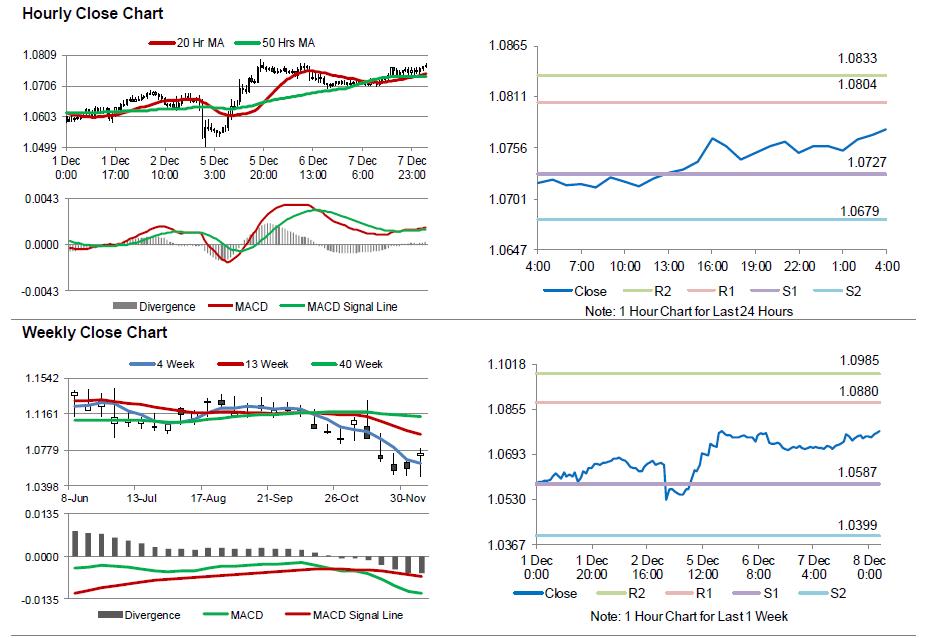

In the Asian session, at GMT0400, the pair is trading at 1.0776, with the EUR trading 0.18% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0727, and a fall through could take it to the next support level of 1.0679. The pair is expected to find its first resistance at 1.0804, and a rise through could take it to the next resistance level of 1.0833.

Ahead in the day, the European Central Bank (ECB) is scheduled to announce its latest monetary policy decision and is widely expected to extend its bond-buying programme. Moreover, in the US, weekly jobless claims data is due to release later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.