For the 24 hours to 23:00 GMT, the GBP declined 0.44% against the USD and closed at 1.2623, after an unexpected downturn in UK’s manufacturing and industrial sector dented the nation’s growth prospects in the fourth-quarter.

Data revealed that UK’s industrial production unexpectedly declined to a four year low of 1.3% MoM in October, defying market anticipation for a gain of 0.2% and compared to a fall of 0.4% in the previous month. Also, the nation’s manufacturing production surprisingly fell 0.9% on a monthly basis in October, posting its largest decline in eight-months. Markets anticipated manufacturing production to advance 0.2%, compared to an increase of 0.6% in the prior month. Meanwhile, leading think tanker, NIESR predicted that UK economy grew 0.4% in the three months to November, compared to a similar pace of growth in the preceding quarter. On the other hand, Halifax house price index rose 0.2% on a monthly basis in November, meeting market expectations and compared to an advance of 1.4% in the prior month.

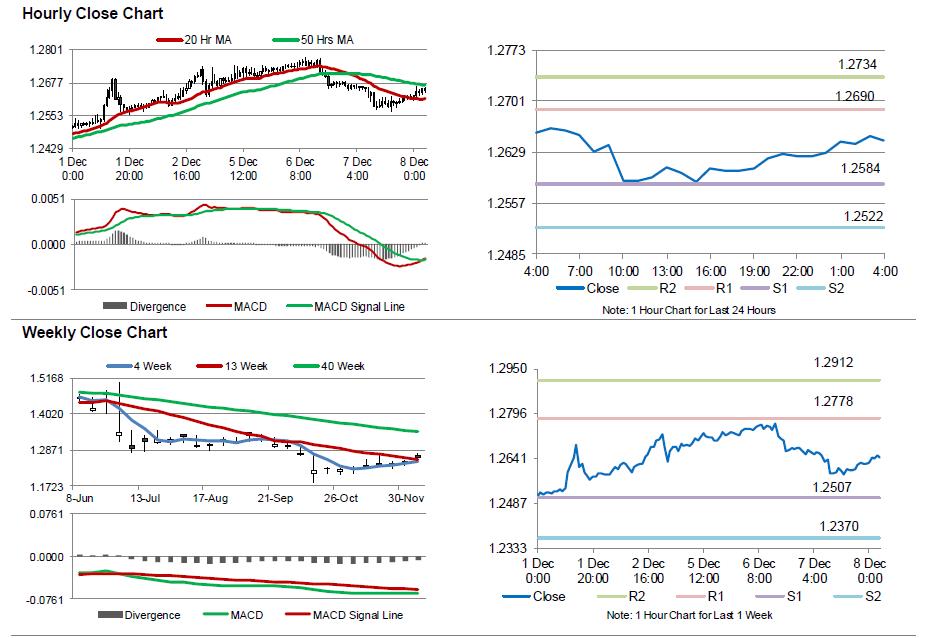

In the Asian session, at GMT0400, the pair is trading at 1.2645, with the GBP trading 0.17% higher against the USD from yesterday’s close.

Overnight data indicated that the nation’s RICS house price balance advanced to 30.0% in November, hitting its highest level in seven-months, compared to market expectations for an advance to 26.0% and after recording a reading of 23.0% in the previous month.

The pair is expected to find support at 1.2584, and a fall through could take it to the next support level of 1.2522. The pair is expected to find its first resistance at 1.269, and a rise through could take it to the next resistance level of 1.2734.

With no further economic releases in the UK today, investors would look forward to global events for direction.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.