For the 24 hours to 23:00 GMT, the EUR declined 0.17% against the USD and closed at 1.0865.

In economic news, Germany’s non-seasonally adjusted GDP grew at its fastest pace since 2011 by 1.7% on YoY basis in 2015, in line with market expectations, mainly driven by a rise in domestic consumption. In the previous year, GDP had advanced 1.6%.

Meanwhile, publication of accounts of the ECB’s meeting on 03 December 2015 revealed that some policy makers argued in favour of making a deeper cut to the deposit rate and stepping up the monthly pace of bond-buying programme, but were outvoted by their colleagues, who argued that sharper cuts could end up “increasing side effects over time”.

In the US, initial jobless claims unexpectedly rose to a level of 284.0K in the week ended 09 January 2016, compared to a reading of 277.0K in the prior week. Markets were expecting initial jobless claims to ease to a level of 275.0K.

Separately, St. Louis Federal Reserve President, James Bullard, warned that an unrelenting decline in crude oil prices may delay the return of inflation to the central bank’s 2.0% target and that this will make it harder for the Fed to raise interest rates further.

In the Asian session, at GMT0400, the pair is trading at 1.0882, with the EUR trading 0.16% higher from yesterday’s close.

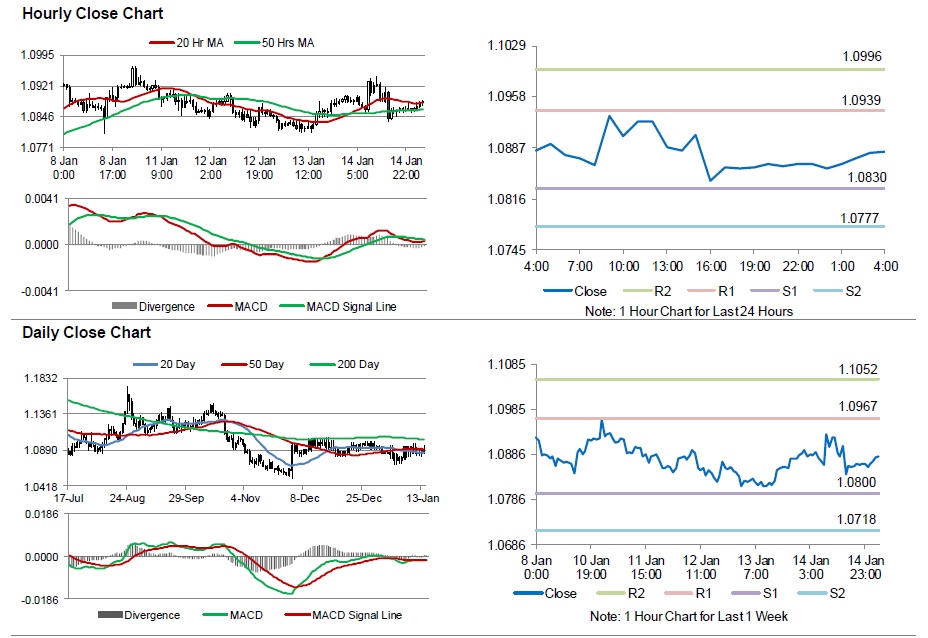

The pair is expected to find support at 1.0830, and a fall through could take it to the next support level of 1.0777. The pair is expected to find its first resistance at 1.0939, and a rise through could take it to the next resistance level of 1.0996.

Moving ahead, market participants will look forward to the Euro-zone’s trade balance data for November, scheduled to release in a few hours. Moreover, the US advance retail sales, industrial production and preliminary Reuters/Michigan consumer sentiment index data, due later today, will also pique investor interest.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.