For the 24 hours to 23:00 GMT, the GBP fell marginally against the USD and closed at 1.4416.

Yesterday, the BoE kept benchmark interest rate unchanged at a historic low of 0.5% over fears that Britain’s economy remains vulnerable amid a fall in oil prices and as concerns over the strength of the global economy resurfaced. Eight of the nine rate-setters on the Monetary Policy Committee voted for no change, with one voting for a rise, while the committee was unanimous and maintained the size of its asset purchase programme unchanged at £375.0 billion. As per minutes of the meeting, the central bank expects the nation’s GDP growth to be weaker by 0.1 percentage point at 0.5% in the last quarter of 2015, and in the first three months of the year.

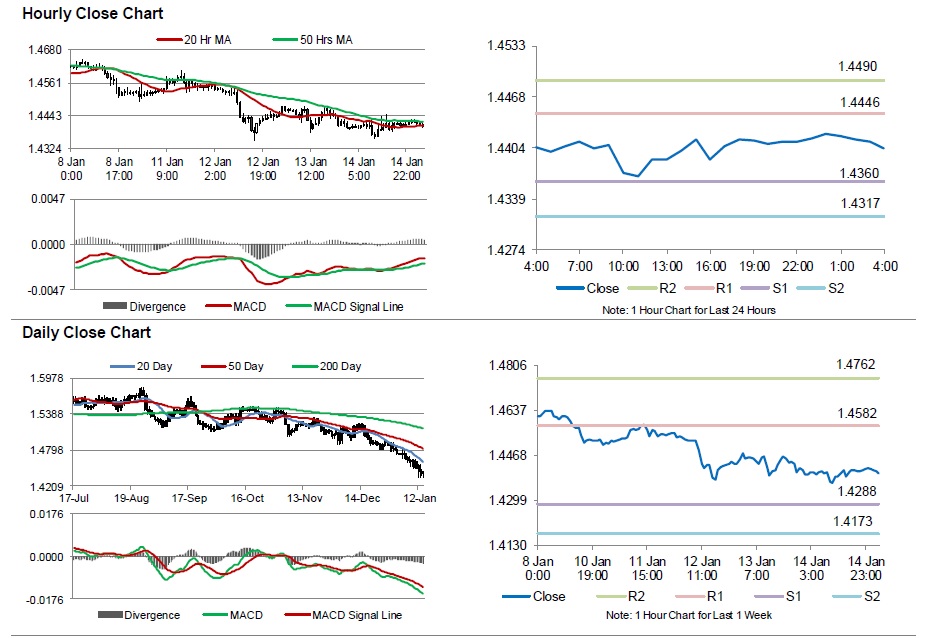

In the Asian session, at GMT0400, the pair is trading at 1.4403, with the GBP trading 0.09% lower from yesterday’s close.

The pair is expected to find support at 1.4360, and a fall through could take it to the next support level of 1.4317. The pair is expected to find its first resistance at 1.4446, and a rise through could take it to the next resistance level of 1.4490.

Going ahead, market participants will look forward to UK’s consumer price inflation, retail sales, ILO unemployment rate and public sector net borrowing data, all scheduled to be released next week.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.