For the 24 hours to 23:00 GMT, the EUR declined 0.21% against the USD and closed at 1.1064.

In the US, the consumer confidence index unexpectedly plunged to 90.9 and notched its lowest level since September 2014 in July, compared to a revised reading of 99.8 in June.

Other economic data showed that the preliminary estimate of the US Markit services PMI advanced more than expected to 55.2 in July, from a reading of 54.8 recorded in June.

In the Asian session, at GMT0300, the pair is trading at 1.1081, with the EUR trading 0.16% higher from yesterday’s close.

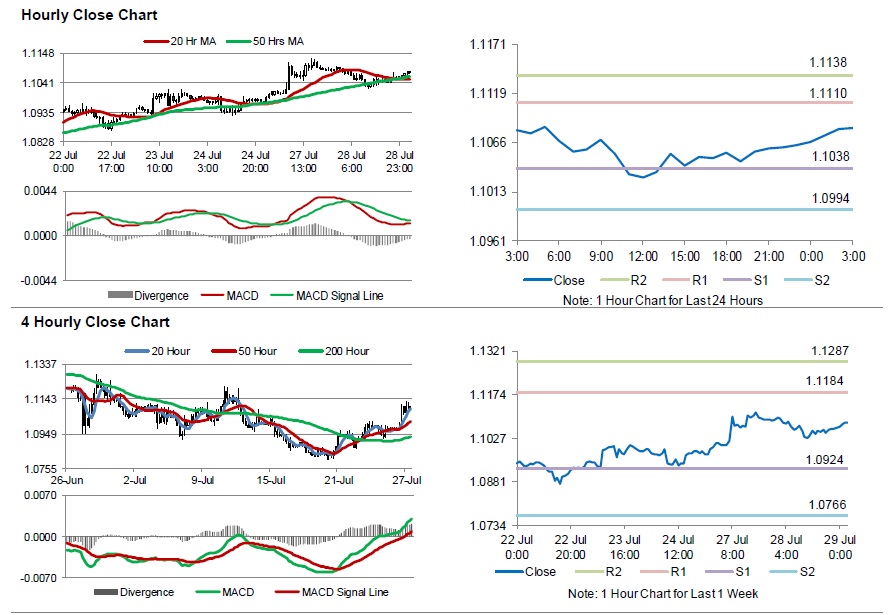

The pair is expected to find support at 1.1038, and a fall through could take it to the next support level of 1.0994. The pair is expected to find its first resistance at 1.1110, and a rise through could take it to the next resistance level of 1.1138.

Trading trends in the Euro today are expected to be determined by Germany’s GfK confidence survey data, scheduled in a few hours. Additionally, the Fed’s interest rate decision, scheduled later today, would grab lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.