For the 24 hours to 23:00 GMT, the GBP rose 0.34% against the USD and closed at 1.5612, after Britain’s economic expansion accelerated in the second quarter of 2015, on the back of robust growth in the nation’s services sector- the biggest contributor to Britain’s GDP.

Data showed that the preliminary print of the nation’s GDP climbed 0.70% QoQ in 2Q 2015, at par with market expectations. It followed a growth of 0.4% registered in the previous month. The positive GDP data indicated that the nation’s economy has picked up momentum, further bolstering the prospects of an interest rate hike by the BoE around the turn of this year.

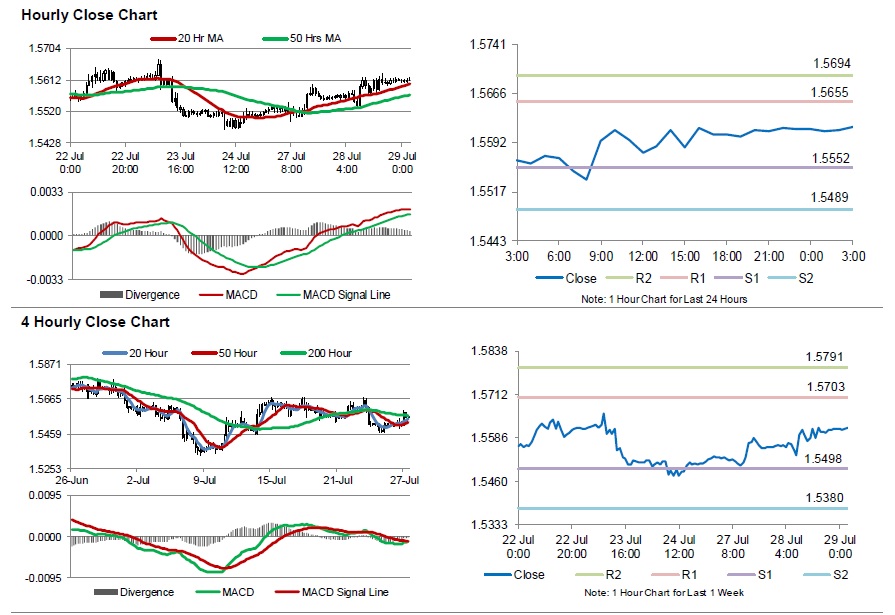

In the Asian session, at GMT0300, the pair is trading at 1.5616, with the GBP trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.5552, and a fall through could take it to the next support level of 1.5489. The pair is expected to find its first resistance at 1.5655, and a rise through could take it to the next resistance level of 1.5694.

Moving ahead, market participants look forward to the release of UK’s mortgage approvals and net consumer credit data, scheduled in a few hours for further direction in the Pound.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.