For the 24 hours to 23:00 GMT, the EUR declined 0.14% against the USD and closed at 1.0893.

In economic news, Italy’s consumer confidence index unexpectedly dropped to a fifteen-month low level of 108.0 in October, declining for a third consecutive month and confounding market expectations for it to remain steady at a revised level of 108.6, recorded in the prior month.

Macroeconomic data released in the US indicated that, preliminary durable goods orders unexpectedly eased by 0.1% on a monthly basis in September, amid lower demand for military hardware and computers. Meanwhile, markets expected durable goods orders to rise by 0.1%, after recording a revised gain of 0.3% in the prior month. Additionally, the nation’s initial jobless claims fell less-than-expected to a level of 258.0K in the week ended 22 October, dropping for the first time in three weeks, compared to a revised level of 261.0K in the previous week while markets expected initial jobless claims to ease to a level of 256.0K. On the contrary, the nation’s pending home sales rebounded by 1.5% MoM in September, higher than market expectations for an advance of 1.2%. In the prior month, pending home sales had recorded a revised fall of 2.5%.

In the Asian session, at GMT0300, the pair is trading at 1.0901, with the EUR trading 0.07% higher against the USD from yesterday’s close.

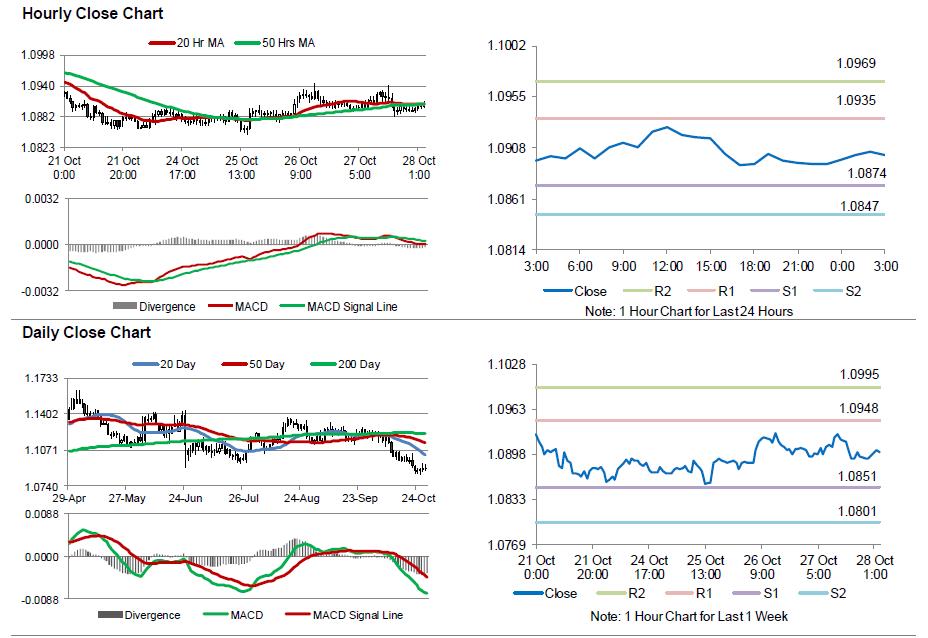

The pair is expected to find support at 1.0874, and a fall through could take it to the next support level of 1.0847. The pair is expected to find its first resistance at 1.0935, and a rise through could take it to the next resistance level of 1.0969.

Looking ahead, market participants would await the release of Germany’s preliminary consumer price index for October, slated to release in a few hours. Additionally, the US flash annualised GDP for 3Q and final Michigan consumer confidence for October, scheduled to be released later in the day, would pique significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.