For the 24 hours to 23:00 GMT, the GBP declined 0.65% against the USD and closed at 1.2156.

On the data front, UK’s preliminary gross domestic product (GDP) expanded more-than-expected by 0.5% on a quarterly basis in 3Q 2016, indicating that Britain’s decision to leave the European Union had little impact on the nation’s economic growth and reducing chances for a fresh interest rate cut by the Bank of England (BoE) at the November meeting. Markets expected the UK economy to grow by 0.3%, following a rise of 0.7% in the previous quarter.

In the Asian session, at GMT0300, the pair is trading at 1.218, with the GBP trading 0.2% higher against the USD from yesterday’s close.

Overnight data showed that, the nation’s GfK consumer confidence index dropped to a level of -3.0 in October, in line with market anticipation, highlighting that Britons grew more pessimistic about the nation’s economic growth prospects. The index had recorded a reading of -1.0 in the prior month.

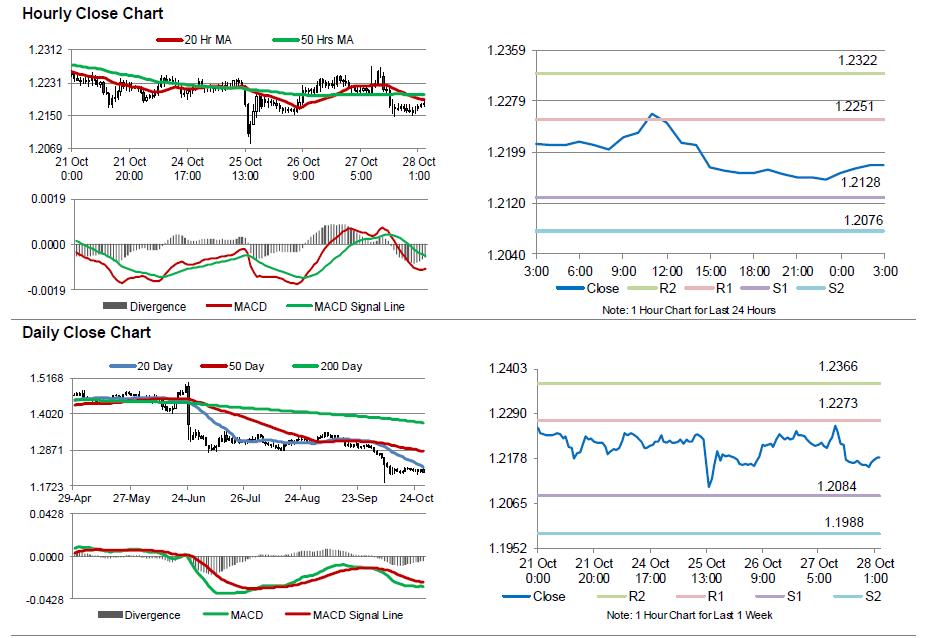

The pair is expected to find support at 1.2128, and a fall through could take it to the next support level of 1.2076. The pair is expected to find its first resistance at 1.2251, and a rise through could take it to the next resistance level of 1.2322.

Going ahead, market participants would turn their attention to the BoE’s interest rate decision along with UK’s Markit manufacturing, services and construction PMIs for October, all due to release next week.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.