For the 24 hours to 23:00 GMT, the EUR declined 0.30% against the USD and closed at 1.1239.

In economic news, the Eurozone’s preliminary consumer confidence index unexpectedly declined to a level of -9.7 in March, dropping for the third consecutive month, compared to a reading of -8.8 in the previous month. Investors had expected it to improve to a level of -8.15.

The greenback gained ground, after two top Fed officials, the Atlanta Fed President, Dennis Lockhart and the Richmond Fed Chief, Jeffrey Lacker, sounded a hawkish tone, suggesting that an interest rate hike was a “live” possibility at the central bank’s upcoming meeting in April.

In other economic news, the US Chicago Fed national activity index declined to a level of -0.29 in February, lower than market expectations of a fall to a level of 0.25. In the prior month, the index had recorded a revised reading of 0.41. Moreover, the nation’s existing home sales fell 7.1% MoM to a level of 5.08 million in February, compared to a level of 5.47 million in the previous month. Markets were anticipating existing home sales to ease to 5.31 million.

In the Asian session, at GMT0400, the pair is trading at 1.1259, with the EUR trading 0.17% higher from yesterday’s close.

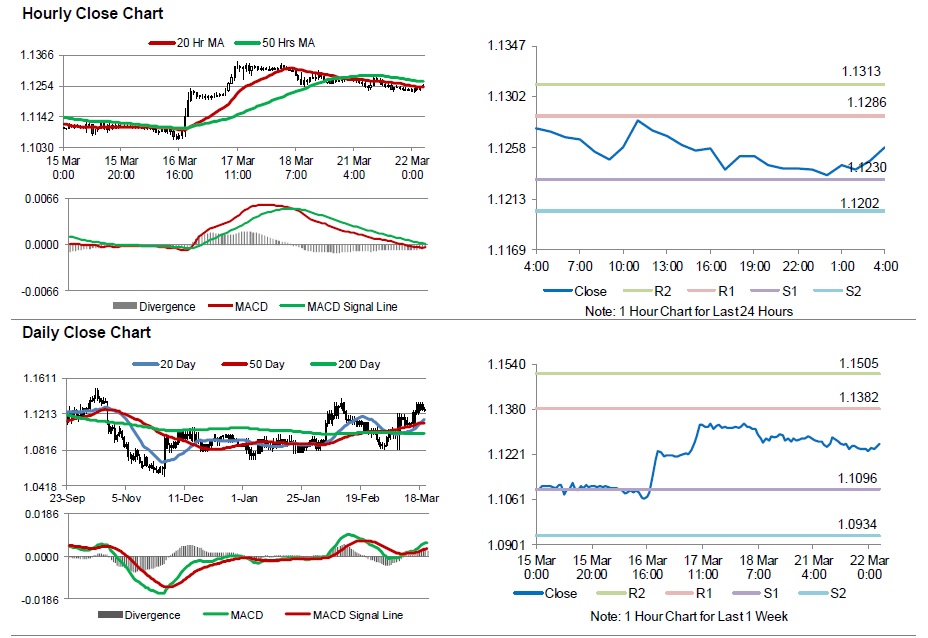

The pair is expected to find support at 1.1230, and a fall through could take it to the next support level of 1.1202. The pair is expected to find its first resistance at 1.1286, and a rise through could take it to the next resistance level of 1.1313.

Moving ahead, investors will look forward to Markit manufacturing and services PMI data along with the IFO survey data, across the Eurozone, scheduled to release in a few hours. Additionally, the US Markit Manufacturing PMI and housing price index data, due later today, will also attract market attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.