For the 24 hours to 23:00 GMT, the GBP fell 0.63% against the USD and closed at 1.4373, over concerns about Prime Minister David Cameron’s ability to keep the Conservative party together ahead of June’s referendum on UK’s European Union membership.

In other economic news, Britain’s CBI trends selling prices rose to a level of -1.0 in March, after registering a reading of -3.0 in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.4379, with the GBP trading marginally higher from yesterday’s close.

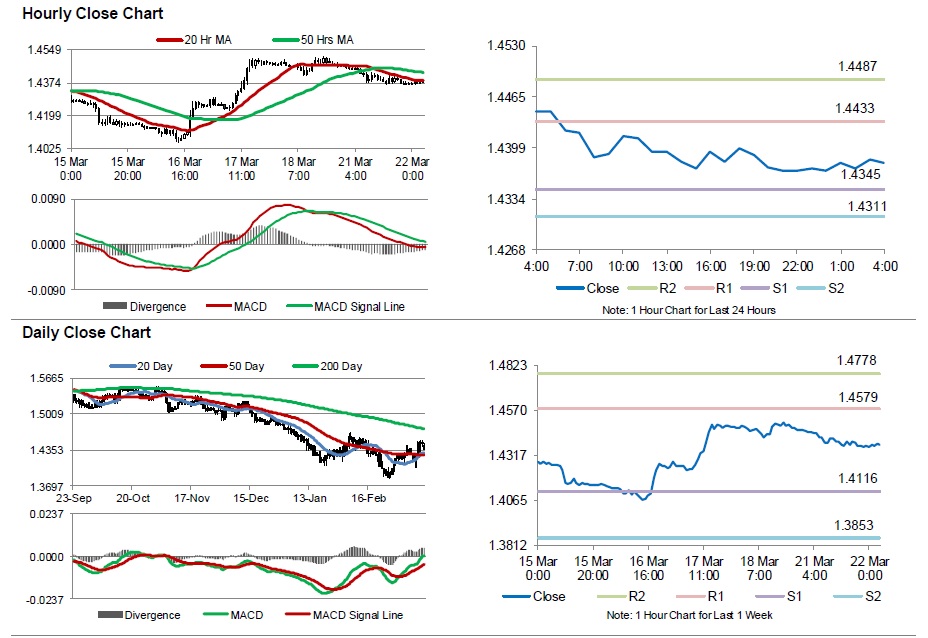

The pair is expected to find support at 1.4345, and a fall through could take it to the next support level of 1.4311. The pair is expected to find its first resistance at 1.4433, and a rise through could take it to the next resistance level of 1.4487.

Going ahead, market participants will look forward to UK’s consumer price index and public sector net borrowing data, both for the month of February, scheduled to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.