For the 24 hours to 23:00 GMT, the EUR rose 0.49% against the USD and closed at 1.1184.

In economic news, the Euro-zone’s final manufacturing PMI remained steady at a three-month low level of 51.50 in May, in line with market expectations. In the previous month, manufacturing PMI had recorded a reading of 51.7. Meanwhile in Germany, final manufacturing PMI declined to a level of 52.1 in May, compared to market expectations of it to remain steady at the preliminary reading of 52.4 and after registering a reading of 51.8 in the previous month.

In the US, the ISM manufacturing activity index registered an unexpected rise to a level of 51.3 in May, compared to a reading of 50.8 in the previous month. Markets were expecting the ISM manufacturing activity index to drop to 50.4. Separately, the US Federal Reserve’s (Fed) Beige Book report indicated that majority of the regions in the US reported modest growth during the April-May period. However, the report noted that the nation’s labour market continued to tighten, pushing wages higher.

Meanwhile, the OECD forecasted the global economy to grow by 3.0% this year and by 3.3% in 2017, both down 0.3% from its November outlook.

In the Asian session, at GMT0300, the pair is trading at 1.1209, with the EUR trading 0.22% higher from yesterday’s close.

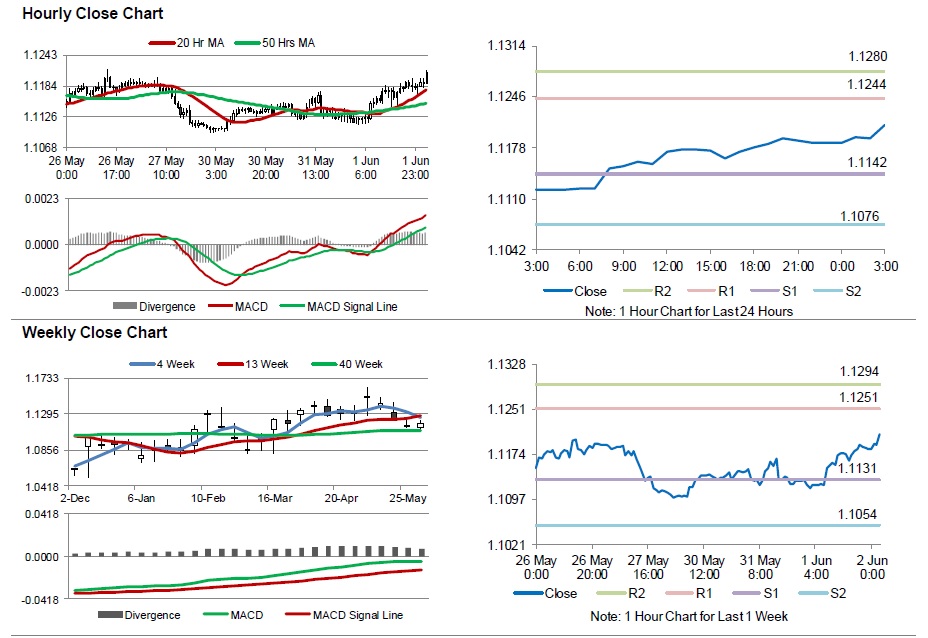

The pair is expected to find support at 1.1142, and a fall through could take it to the next support level of 1.1076. The pair is expected to find its first resistance at 1.1244, and a rise through could take it to the next resistance level of 1.1280.

Going ahead, investors will look forward to the ECB’s interest rate decision, scheduled to be announced later today. Additionally, the US initial jobless claims and the ADP employment change data for May, due later in the day, will also attract market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.