For the 24 hours to 23:00 GMT, the GBP fell 0.52% against the USD and closed at 1.4416.

In economic news, UK’s seasonally adjusted Markit manufacturing PMI advanced above expectations to a level of 50.1 in May, compared to a revised level of 49.4 in the previous month. Markets were anticipating the manufacturing PMI to rise to a level of 49.6. Meanwhile, the nation’s net consumer credit increased by £1.3 billion in April, lower than market expectation for a rise of £1.6 billion. It had risen by a revised £1.8 billion in the previous month. The nation’s mortgage approvals followed the same trend and dropped to a one-year low level of 66.3K in April, compared to market expectations of a drop to a level of 67.9K. In the prior month, number of mortgage approvals for house purchases had recorded a revised reading of 70.3K. Further, Britain’s seasonally adjusted nationwide housing prices climbed 0.2% MoM in May, lower than market expectations for an advance of 0.3%. House prices had risen by 0.2% in the previous month.

Separately, the Organisation for Economic Co-operation and Development (OECD), indicated that Brexit would scar the British as well as the global economies over the short and long term. Further, the OECD slashed its growth forecast for the UK economy to 1.7% this year, down from 2.2% predicated in February.

In the Asian session, at GMT0300, the pair is trading at 1.4421, with the GBP trading marginally higher from yesterday’s close.

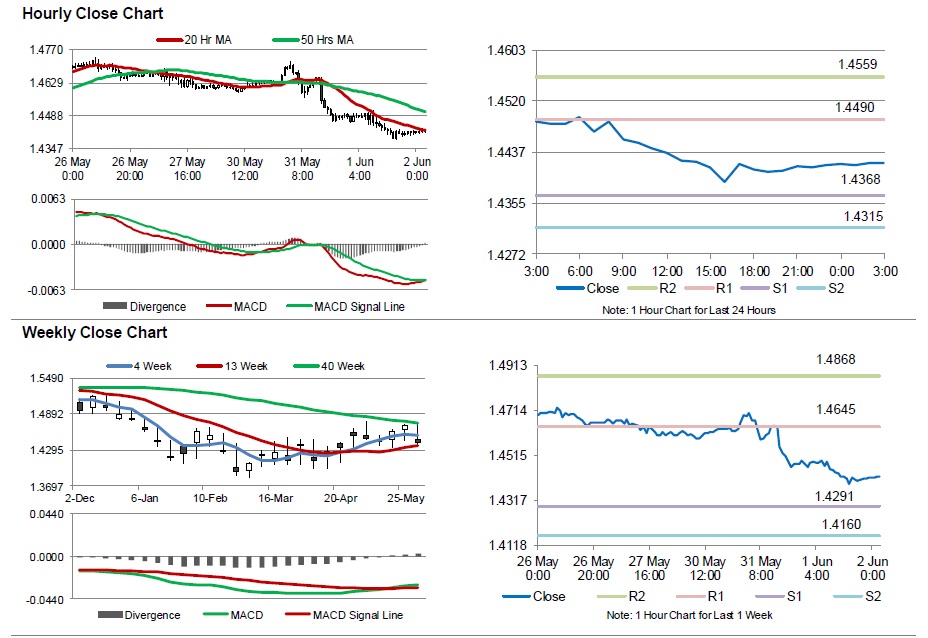

The pair is expected to find support at 1.4368, and a fall through could take it to the next support level of 1.4315. The pair is expected to find its first resistance at 1.4490, and a rise through could take it to the next resistance level of 1.4559.

Going ahead, investors will look forward to the BoE Governor, Mark Carney’s speech, due later today.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.