For the 24 hours to 23:00 GMT, the EUR declined marginally against the USD and closed at 1.1010, after Euro-zone’s preliminary consumer confidence index fell to a level of -7.9 in July, indicating that consumers became less optimistic about the region’s economic growth following the Brexit vote. However, the fall was less-than-expected as the market anticipated the index to drop to a level of -8.0, after registering a revised reading of -7.2 in the previous month. Additionally, the region’s seasonally adjusted current account surplus dropped to €30.8 billion in May, compared to a revised surplus of €36.4 billion in the previous month. Separately, Germany’s producer price index rose more-than-expected by 0.4% MoM in June, following a similar rise in the preceding month.

In the US, data indicated that MBA mortgage applications declined by 1.3% in the week ended 15 July, compared to a rise of 7.2% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1020, with the EUR trading 0.09% higher against the USD from yesterday’s close.

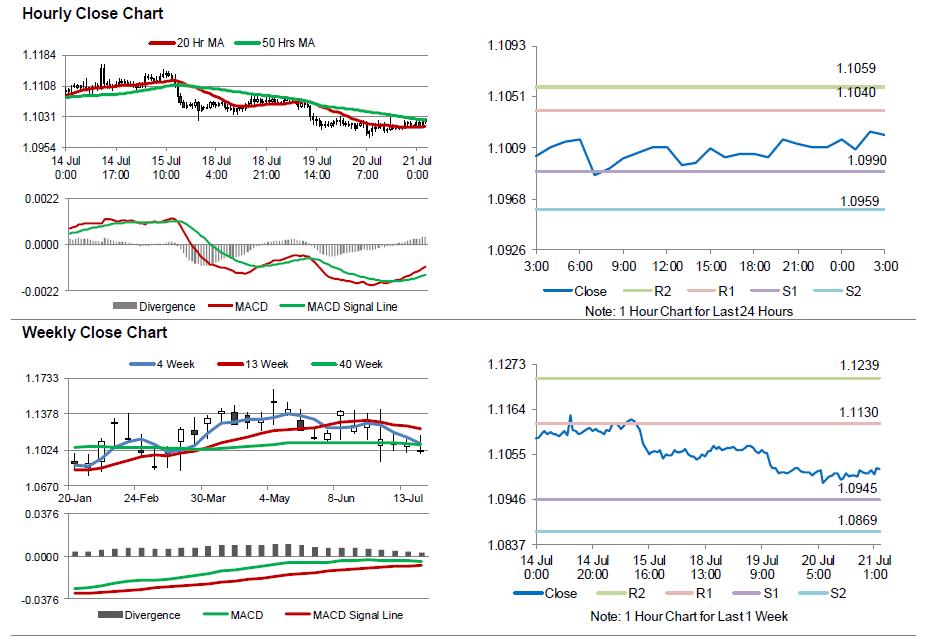

The pair is expected to find support at 1.099, and a fall through could take it to the next support level of 1.0959. The pair is expected to find its first resistance at 1.1040, and a rise through could take it to the next resistance level of 1.1059.

Going ahead, market participants would keenly await the closely watched – European Central Bank’s (ECB) interest rate decision – scheduled later today and which is widely expected to remain steady at 0%. Additionally, in the US, initial jobless claims, along with Philadelphia Fed manufacturing survey as well as existing home sales, slated to be released later in the day, would keep investors on their toes.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.