For the 24 hours to 23:00 GMT, the GBP rose 0.89% against the USD and closed at 1.3225, after better-than-expected jobs data along with BoE’s survey that showed limited Brexit fallout.

Macroeconomic data indicated that, UK’s ILO unemployment rate unexpectedly eased to an eleven-year low level of 4.9% QoQ in the three months to May, a sign that labour market continued to strengthen before the country’s decision to leave the European Union. Meanwhile, markets expected the unemployment rate to remain steady at 5.0%. Moreover, the nation’s average earnings including bonus rose by 2.3% YoY in the March-May quarter, at par with market expectations, recording its highest rise since October 2015 and following a rise of 2.0% in the previous month.

Separately, the BoE, in a survey indicated that, despite an increase in business uncertainty after last month’s Brexit vote, there were no signs of a slowdown in economic activity in UK. It also revealed that expectations for investment spending lowered and demand for credit was easing. Nevertheless, it noted that majority of companies did not expect any near-term impact on capital spending from the vote.

In the Asian session, at GMT0300, the pair is trading at 1.3221, with the GBP trading marginally lower against the USD from yesterday’s close.

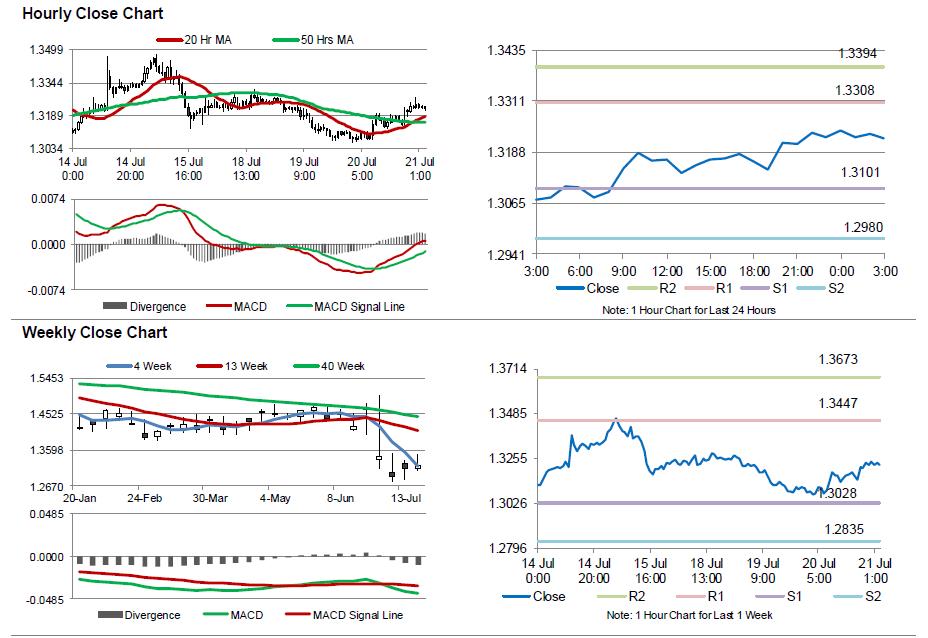

The pair is expected to find support at 1.3101, and a fall through could take it to the next support level of 1.298. The pair is expected to find its first resistance at 1.3308, and a rise through could take it to the next resistance level of 1.3394.

Moving ahead, UK’s retail sales and public sector net borrowing data, scheduled to release in a few hours, will be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.