For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.1239, after Germany’s seasonally adjusted industrial production surprisingly fell 1.5% MoM in July, following a revised 1.1% gain in the previous month.

In the US, JOLTs job openings unexpectedly advanced to a level of 5871.0 K in July, compared to a revised level of 5643.0 K in the prior month.

Separately, the US Federal Reserve’s Beige Book report indicated that wage pressures in most of the central bank’s 12 districts remained “fairly modest” and were expected to remain so during the coming months. Further, activity in the nation’s manufacturing sector “was flat to slightly up”.

In the Asian session, at GMT0300, the pair is trading at 1.1252, with the EUR trading 0.12% higher against the USD from yesterday’s close.

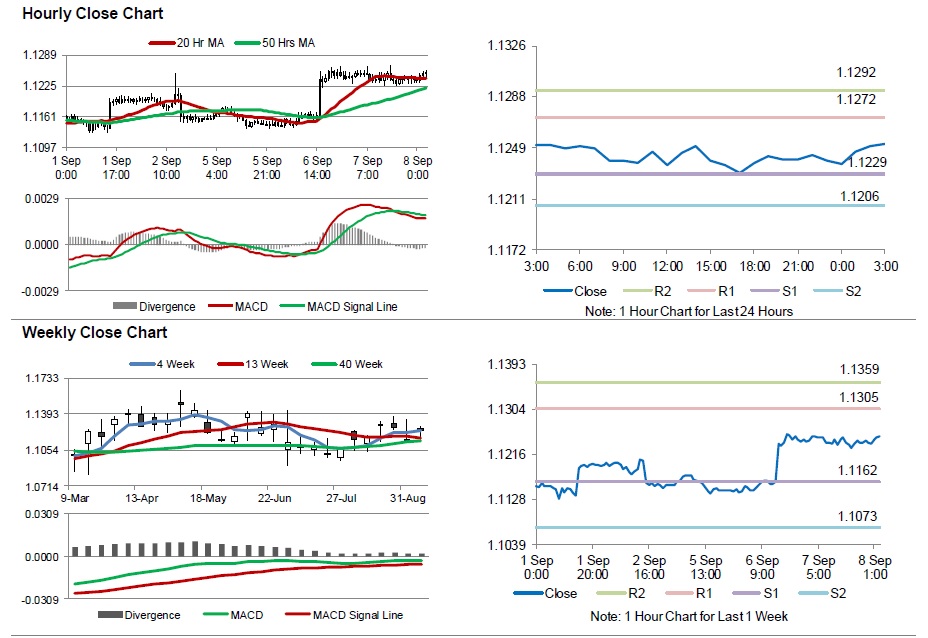

The pair is expected to find support at 1.1229, and a fall through could take it to the next support level of 1.1206. The pair is expected to find its first resistance at 1.1272, and a rise through could take it to the next resistance level of 1.1292.

Going ahead, investors await the European Central Bank’s (ECB) interest rate decision, scheduled to be announced later today. Also, the US weekly jobless claims data, due later in the day, will attract market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.