For the 24 hours to 23:00 GMT, the GBP fell 0.65% against the USD and closed at 1.3338, after UK’s manufacturing production declined more-than-expected by 0.9% MoM in July, in the aftermath of the shock Brexit vote, recording its steepest fall in a year. In the previous month, it had registered a revised drop of 0.2%. On the other hand, the nation’s industrial production surprisingly rose 0.1% MoM in July, following a revised flat reading in the previous month. Further, Britain’s NIESR estimated gross domestic product (GDP) climbed 0.3% on a monthly basis in the UK, in the June-August 2016 period. In the May-July 2016 period, NIESR estimated GDP had advanced by a revised 0.4%.

Separately, the Bank of England (BoE) Governor, Mark Carney, in his testimony to the Treasury Select Committee, defended his comments made ahead of the referendum and the central bank’s policy actions since the vote.

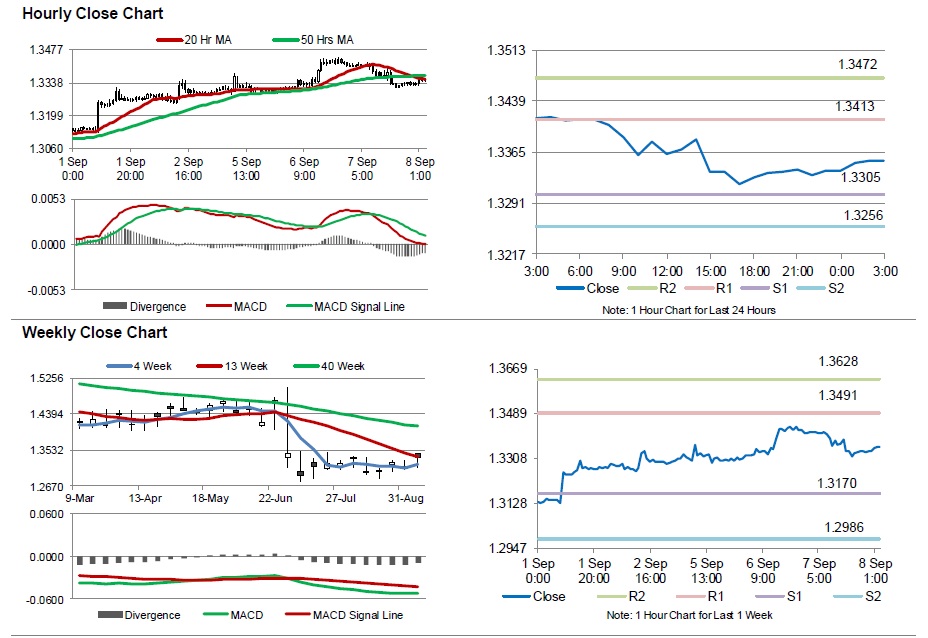

In the Asian session, at GMT0300, the pair is trading at 1.3353, with the GBP trading 0.11% higher from yesterday’s close.

The pair is expected to find support at 1.3305, and a fall through could take it to the next support level of 1.3256. The pair is expected to find its first resistance at 1.3413, and a rise through could take it to the next resistance level of 1.3472.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.