For the 24 hours to 23:00 GMT, the EUR declined 0.90% against the USD and closed at 1.2837, after consumer price inflation in the Euro-zone remained below the ECB’s target of near but below 2%, despite introducing additional stimulus measures by the central bank in its recent monetary policy meeting.

The consumer price index (CPI) in the Euro-zone rose 0.1%, on a monthly basis in August, in line with market expectations and compared to a 0.7% fall registered in the previous month. Meanwhile, the seasonally adjusted construction output in the region remained steady in July on a monthly basis, after registering a revised drop of 0.4% in the prior month.

Yesterday, in the US, the Fed maintained its interest rate at 0.25%, in line with market expectations and reduced its monthly asset purchases from $25.0 billion to $15.0 billion a month. Separately, the Fed Chairwoman, Janet Yellen, stated in a Press Conference that the central bank’s policy making committee is in no hurry to raise the interest rates and pledged to keep them near zero for a “considerable time”. She further indicated that despite recent improvement in the US job market, the policy makers were cautious about their assessment of the jobs situation, acknowledging significant slack in the labour market. However, the Fed, at its Summary of Economic Projections, said that the rate will be 3.75% by the end of 2017.

In other economic news, the CPI in the US unexpectedly fell 0.2%, on a monthly basis, in August, lesser than market expectations for a steady reading and compared to a rise of 0.1% registered in the previous month. Meanwhile, the NAHB housing price index in the nation rose to a 9-year high to 59.0 in September, compared to a level of 55.0 registered in the previous month. Additionally, the US registered a current account deficit of $98.5 billion in 2Q 2014, compared to a deficit of $102.1 billion in the prior quarter. Market anticipations were for the nation to record a current account deficit of $113.4 billion.

In the Asian session, at GMT0300, the pair is trading at 1.2857, with the EUR trading 0.16% higher from yesterday’s close.

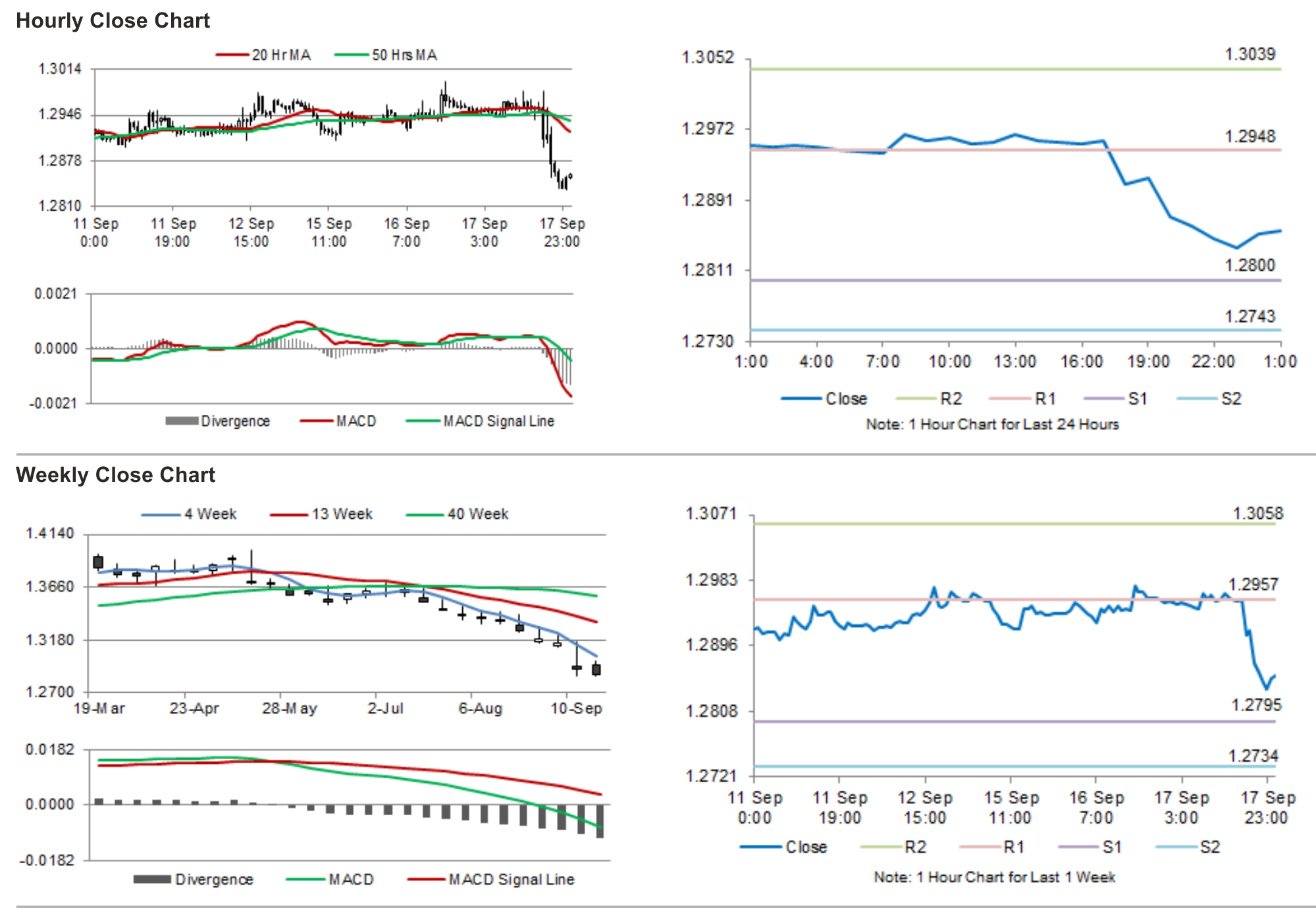

The pair is expected to find support at 1.2800, and a fall through could take it to the next support level of 1.2743. The pair is expected to find its first resistance at 1.2948, and a rise through could take it to the next resistance level of 1.3039.

Trading trends in the Euro today are expected to be determined by the ECB TLTRO allotment, scheduled in a few hours. Meanwhile, investors would also keenly wait for the initial jobless claims data from the US, also scheduled to release ahead in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.