For the 24 hours to 23:00 GMT, the EUR rose 0.26% against the USD and closed at 1.0581.

The US Dollar lost ground against its key counterparts, after the US President-elect Donald Trump’s highly anticipated news conference failed to offer any clarity on his future fiscal policies.

In economic news, mortgage applications in the US climbed 5.8% in the week ended 06 January 2017, following a rise of 0.1% in the previous week. Additionally, the nation’s IBD/TIPP economic optimism index rose to a level of 55.6 in January, after recording a level of 54.8 in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.0611, with the EUR trading 0.28% higher against the USD from yesterday’s close.

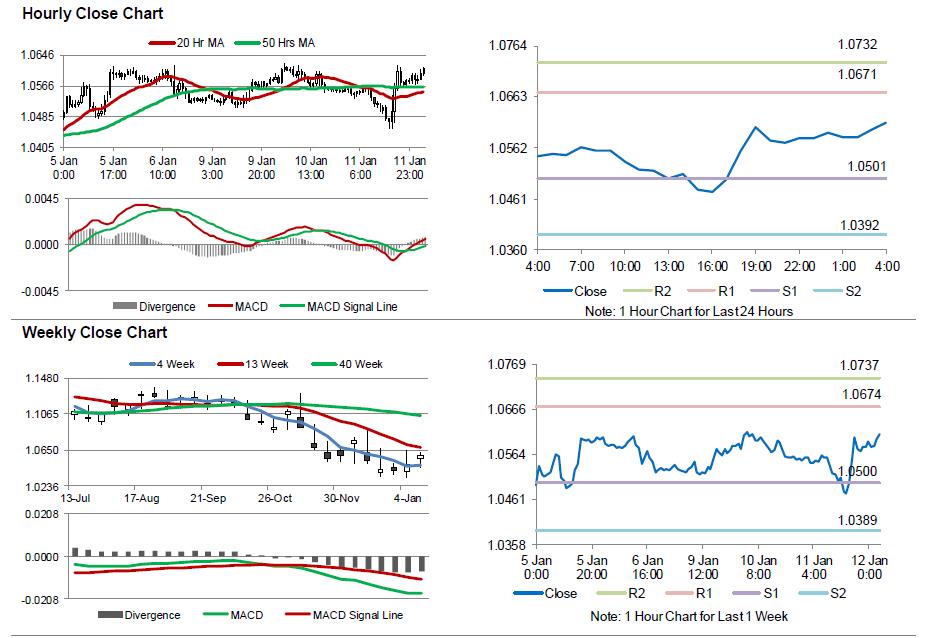

The pair is expected to find support at 1.0501, and a fall through could take it to the next support level of 1.0392. The pair is expected to find its first resistance at 1.0671, and a rise through could take it to the next resistance level of 1.0732.

Ahead in the day, investors will look forward to the ECB’s recent meeting minutes along with the Euro-zone’s industrial production data for November, scheduled to release in a few hours. Moreover, the US weekly jobless claims and monthly budget statement for December, slated to release later in the day, will also grab a lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.