For the 24 hours to 23:00 GMT, the GBP rose 0.26% against the USD and closed at 1.2204, after better-than-expected industrial and manufacturing output data in the UK for November suggested that the economy broadly continued its post-referendum momentum.

Data showed that UK’s industrial production rebounded more-than-anticipated by 2.1% on a monthly basis in November, notching its largest increase in seven months. Industrial production registered a revised drop of 1.1% in the previous month, while investors had envisaged for a rise of 0.9%. Moreover, the nation’s manufacturing production advanced 1.3% on a monthly basis in November, beating market consensus for a rise of 0.5% and compared to a revised drop of 1.0% in the previous month. Further, leading think tanker, NIESR estimated that UK’s economy grew 0.5% during the three months to December, at par with market expectations and following a similar revised rise in the three months ended November. On the other hand, the nation’s total trade deficit widened more-than-expected to £4.2 billion in November, as record high imports outweighed exports. The nation posted a revised trade deficit of £1.6 billion in the prior month, while markets expected for a deficit of £3.5 billion. Also, the nation’s construction output unexpectedly fell 0.2% MoM in November, defying market expectations for a gain of 0.3% and following a decline of 0.6% in the preceding month.

Meanwhile, the Bank of England (BoE) Governor, Mark Carney, in a speech to the Treasury Select Committee, stated that Brexit is no longer the biggest domestic risk to Britain’s economy, thus reversing his previous warnings about Brexit being the most significant short-term risk to the UK’s financial stability. He also signalled that the central bank may upgrade UK’s economic growth forecast.

In the Asian session, at GMT0400, the pair is trading at 1.2209, with the GBP trading marginally higher against the USD from yesterday’s close.

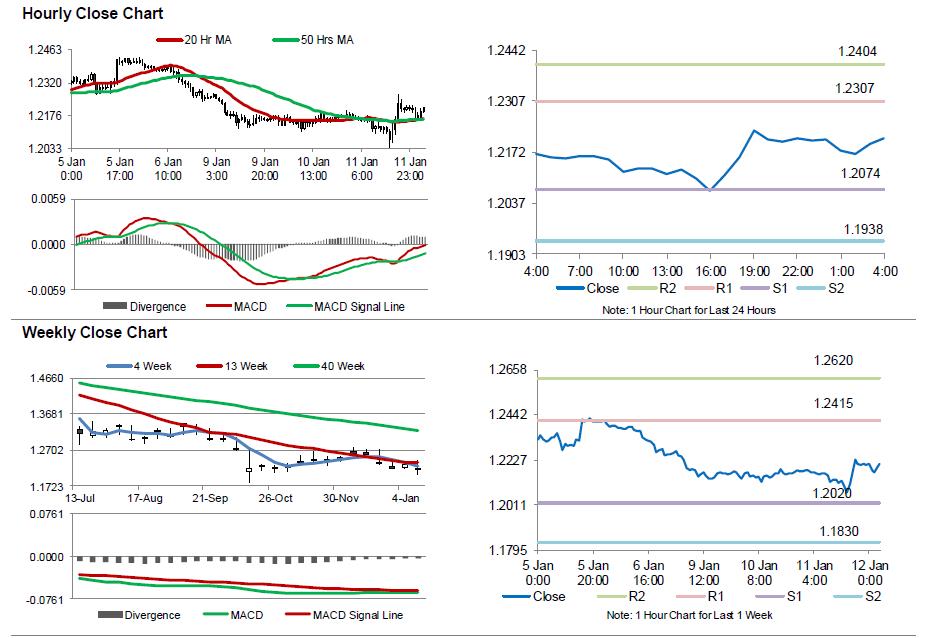

The pair is expected to find support at 1.2074, and a fall through could take it to the next support level of 1.1938. The pair is expected to find its first resistance at 1.2307, and a rise through could take it to the next resistance level of 1.2404.

Amid no economic releases in the UK today, investor sentiment will be governed by global macroeconomic factors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.