For the 24 hours to 23:00 GMT, the EUR declined 0.50% against the USD and closed at 1.1255.

In economic news, the Euro-zone economic sentiment index unexpectedly rose to a level of 20.2 in June, following a reading of 16.8 in the previous month. Meanwhile in Germany, the economic sentiment index surprisingly advanced to a ten-month high level of 19.2 in June, weathering the risks of a possible ‘Brexit’. Investors had expected it to drop to a level of 4.8, after recording a reading of 6.4 in the prior month. Likewise, the nation’s current situation index surprisingly rose to a five-month high level of 54.5 in June, from a reading of 53.1 in the previous month.

Separately, the European Central Bank President, Mario Draghi, indicted that risks emanating from a potential Brexit is challenging and that the central bank has taken all the necessary measures in the event of a UK vote to leave European Union.

In the US, the Federal Reserve (Fed) Chairwoman, Janet Yellen, in a testimony to the Senate Banking Committee, indicated that a cautious approach to monetary policy remains appropriate given that the pace of improvement in the labour market has slowed. However, she assured that headwinds holding back the economy will “slowly fade over time” and further gradual increases in interest rates are likely needed. She further added that a departure by Britain from the EU could lead to increased volatility in global financial markets but does not believe that the US would see a “Brexit-induced” recession.

In the Asian session, at GMT0300, the pair is trading at 1.1262, with the EUR trading 0.06% higher against the USD from yesterday’s close.

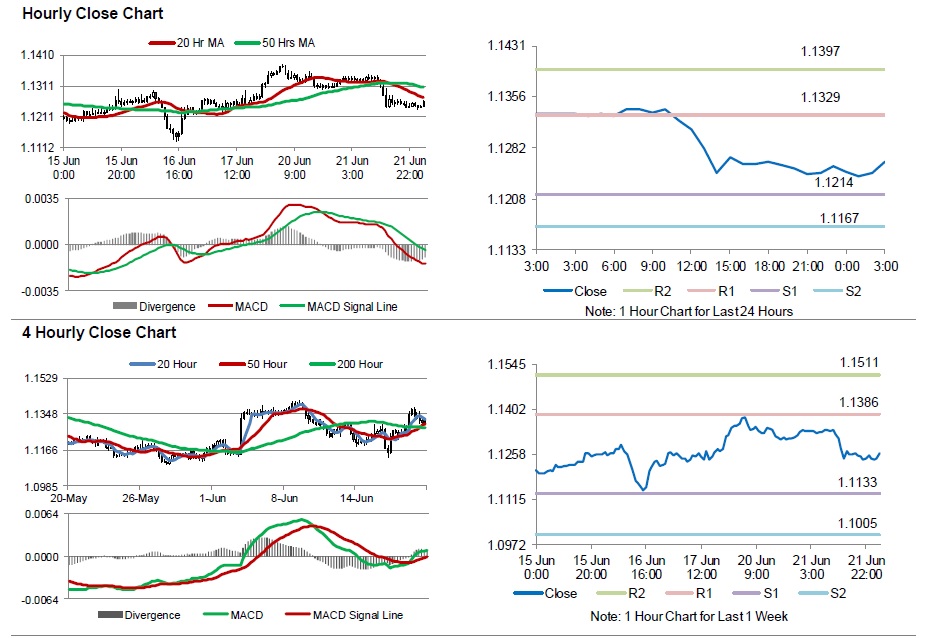

The pair is expected to find support at 1.1214, and a fall through could take it to the next support level of 1.1167. The pair is expected to find its first resistance at 1.1329, and a rise through could take it to the next resistance level of 1.1397.

Going ahead, investors will look forward to the Euro-zone’s flash consumer confidence index data for June, scheduled to release later today. Moreover, the US Fed Chairwoman, Janet Yellen’s, testimony to the House Financial Services Committee, along with the US existing home sales and weekly mortgage applications data, due later in the day, will also attract market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.