For the 24 hours to 23:00 GMT, the GBP fell 0.08% against the USD and closed at 1.4662, after UK’s public sector net borrowing deficit widened to a level of £9.10 billion in May, from a revised deficit of £7.60 billion in the previous month. Market expectation was for public sector net borrowing to show a deficit of £9.40 billion. On the other hand, the nation’s CBI industrial trends total orders improved to a 10-month high level of -2.0 in June, from a reading of -8.0 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.4684, with the GBP trading 0.15% higher against the USD from yesterday’s close.

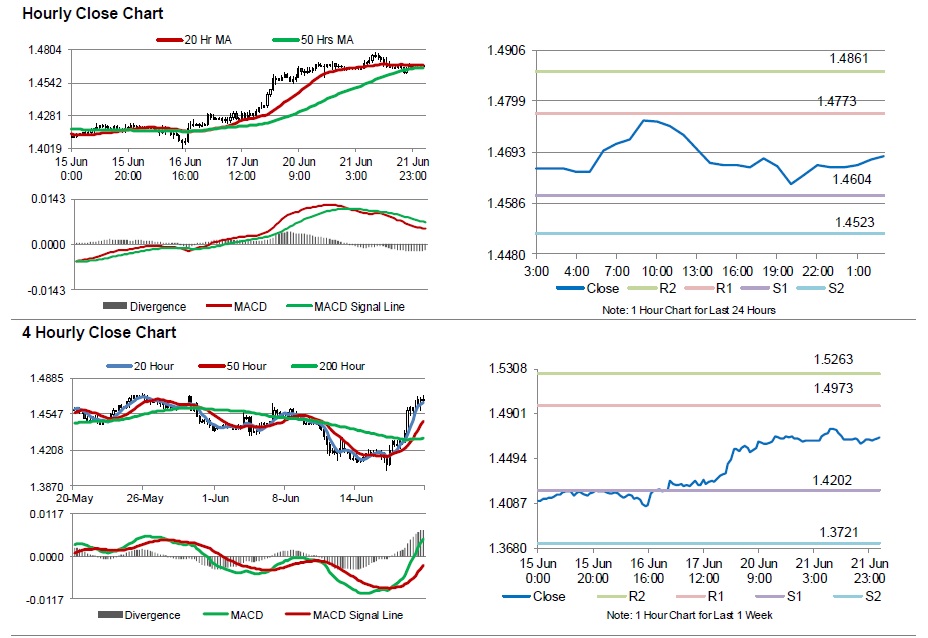

The pair is expected to find support at 1.4604, and a fall through could take it to the next support level of 1.4523. The pair is expected to find its first resistance at 1.4773, and a rise through could take it to the next resistance level of 1.4861.

With no economic releases in the UK today, market participants will brace themselves for tomorrow’s European Union referendum vote.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.